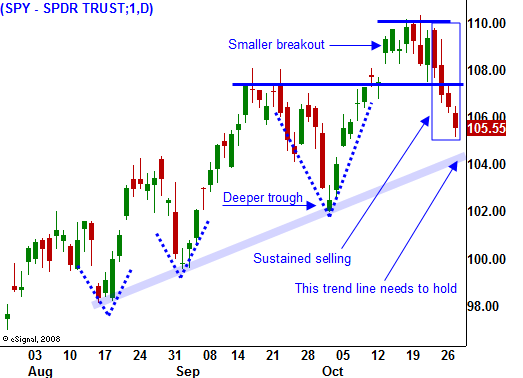

The Market Will Continue To Probe For Support. As Long As The Trend Is Intact – Line Up Your Longs!

Yesterday, the market continued to slip and now we have four consecutive days of heavy selling. The breakout from two weeks ago has failed and we are approaching a very significant support level at SPY $104. That is the uptrend line that dates back three months. We are currently just above the 50-day moving average.

In today's chart, you can see that the recent trough a month ago was deeper than the previous dips. The recovery and subsequent breakout was also smaller in magnitude. Recently, sustained selling pressure has appeared for the first time since July. This price action suggests that resistance is forming. Intermediate support levels are still intact and it is premature to get bearish.

Interest rates are low, although they are poised to move higher in the near future. On a global basis, other countries are prepared to hike interest rates. The Fed's desire to keep interest rates low is irrelevant. Once global rates start to rise, capital will flow to those markets and our bond auctions will not fare as well as they have. The implied interest rate will rise. I still feel that we are a couple of months away from this upward pressure.

Earnings have been excellent but the guidance has been a bit on the cautious side. Stocks are fairly valued at this level and top line growth will be needed for them to move higher.

I have two major concerns with this rally. Oil is the fabric to every economy and demand is not picking up. That makes me very suspicious of a global economic recovery. Secondly, transportation stocks are not providing robust guidance. Shipping volumes are still low and improvement continues to get pushed out into the future. These are not lagging indicators, they are leading indicators.

Today, durable goods orders came in as expected. They rose 1% in September. This is a very volatile number and it did not spark much of a reaction. Goldman Sachs revised its estimate for Q3 GDP down to 2.7%. The consensus estimate is for a 3% growth rate. That news might be weighing on the market today. I would argue that any number above 2.5% should be long-term bullish. There might be an initial negative reaction tomorrow if the GDP comes in at 2.7%, but the number still shows excellent improvement from a -5.4% Q1 number and a -1% Q2 number. Initial jobless claims will also be released tomorrow. They were worse than expected last week. This is also a volatile number and the four-week moving average is a better gauge for employment. Continuing claims fell below 6 million last week and it's important for that trend to continue. Given the negative price action the last few days, I feel that we are slightly oversold and tomorrow's numbers should provide some support.

Earnings have been good, but most stocks have declined after posting results. Looking at the overall picture for tomorrow's open, I would give the earnings releases a positive bias. Insurance companies should post great results and so should energy companies. These are the primary announcements after the close and before the open.

I am selling out of the money put spreads on strong stocks, but I am doing so in a very small way. End of month /beginning of the month fund buying will add a small bid to this market over the next few days. I feel that we are close to support, but I expect to see nervousness ahead of the Unemployment Report next week. It is important to have your stocks lined up because the bounce is likely to be fast and furious into year end. Retail and technology should fare the best.

A breakdown below SPY $104 would be negative, but it will take a close below SPY $102 for me to start closing down my bullish put spreads.

Profit-taking has set in and buyers will patiently wait for signs of support. Once it is established, they will step in quickly. I don't believe we will see a big decline heading into year end. Solid earnings, low interest rates and "less bad" economic numbers will support the market.

The market is drifting lower and we are likely to keep probing for support today.

Daily Bulletin Continues...