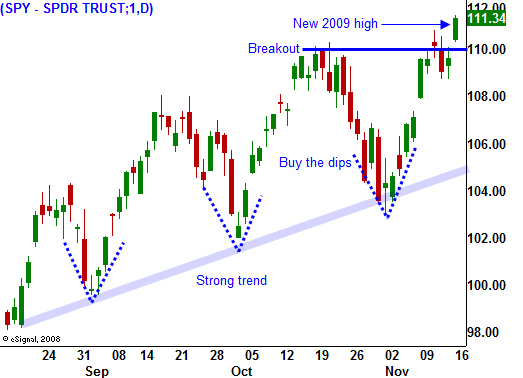

A New High For 2009. Option Expiration Will Fuel The Rally.

Last week, the market found support and it rallied back to the highs of the year. It stayed within striking distance, but was not able to break out.

This morning, strong performance in global markets provided a springboard and we have new highs for 2009. Retail sales rose 1.4% last month and that was better than the 1% analysts had expected. There are signs that spending is increasing, but consumers are still cautious. The Empire Manufacturing Index tends to be volatile and it declined from 34.57 down to 23.51 last month.

We have a number of economic releases this week, but none of them have generated more than a temporary move in the market. Inflation has been benign and PPI/CPI should not generate much of a move. Industrial production, housing starts, LEI, initial claims and Philly Fed will be released this week. All should show "less bad" economic conditions and each has the potential to spark a small rally. That impetus could fuel option expiration buy programs.

We are making new highs for the year and option traders that are short calls might be forced to buy them back. This short covering could lead to a nice rally. However, bears have been carried out in body bags in the last 6 months and I do not believe that we will see the type of short covering that we witnessed in the last few months.

This is what I would consider to be a "manufactured" rally. It has more to do with option expiration and a technical breakout than with fundamental improvement. Consequently, these rallies tend to reverse quickly once the momentum subsides. It is important to sell into strength. As you can see in today's chart, the market takes two steps forward and one step backwards.

The volume during the last few weeks has dropped off and that could be a sign of resistance. Buyers are not as eager to place money at these levels. The depth of the declines has increased and volatility is creeping back in to the market.

Solid earnings, low interest rates, economic improvement, seasonal strength and M&A activity should keep a bid under this market through year-end. Judging the depth of the dips and the magnitude of the breakouts, we could see SPY 114 during this mini trading cycle. There is upside, but it is rather contained. The decline that we saw two weeks ago tells me that the backside could be slippery, don't overstay your welcome.

I have been selling December out of the money put options. In the next few days I will have 25% of my desired Dec position and then I will wait for a pullback and support before I add.

Advancers outnumber decliners by 5 to 1 and given the new highs during option expiration, I believe the market will rally right into the closing bell. The Fed Chairman will speak this afternoon, but I do not expect any new information. This should be a positive week for the market. If you are long calls, set aggressive targets and let the market come to you. Sell into strength and try to be out by the end of the week.

Daily Bulletin Continues...