Decent Economic News and Option Expiration Could Spark A Breakout Next Week – Be Careful!

After a big run-up early in the week, the market has not been able to penetrate overhead resistance. Wednesday, we rallied on the open to a new high for 2009 and by midday, prices backed off considerably. Yesterday, the market chopped around and finally tested the downside. In early trading today, the market has been in positive and negative territory.

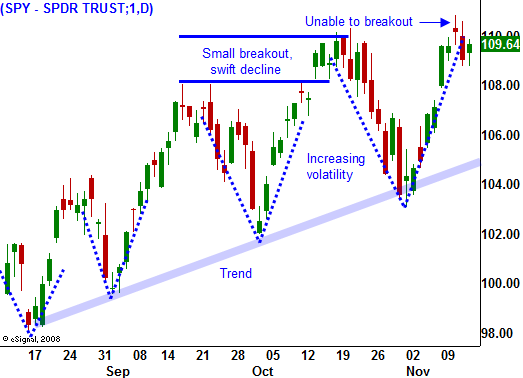

If you look at today's chart you'll notice that each dip led to a rally that broke out to new highs. You will also notice that each dip was greater in magnitude. When the market staged its last breakout in October, it did not rally far before hitting resistance. The subsequent decline was sustained and this resistance level is formidable. We have tried to penetrate it this week unsuccessfully. If the market can't close above SPY 110 early next week, is likely to back off.

The news next week is fairly light. There will be many economic releases, but none are significant enough to generate a sustained rally. Earnings will be highlighted by retail stocks. That has been one of the strongest sectors and we got a glimpse at earnings (Wal-Mart, Kohl's, Macy's and JC Penney’s) this week. The reaction has been mixed, and the sector has been able to tread water. This price action tells me that retail earnings will not be the upside catalyst we are looking for.

Option expiration has been positive and given that we are near the upper end of the one-month trading range, we could see buy programs. One or two pieces of good news could spark a rally that forces shorts to cover.

This would be a "manufactured rally" and it is not necessarily the type of breakout we would like to see. Ideally, there would be a material piece of information that legitimately fuels a rally. From a trading standpoint this doesn’t matter. It simply means that we need to careful on the backside. You can trade the rally, but be careful and take profits quickly. If profit-taking is starting to grow, the reversal after the breakout could be swift and sharp.

I still believe that good earnings, low interest rates and "less bad" economic numbers will support this market during a seasonally bullish period. However, I am only a buyer on pullbacks. The last breakout we had failed very quickly and if you overstayed your welcome, you lost money. That's why I would not be a major player next week if we do see a rally. At most, I will day trade strong stocks on a breakout and take profits before the close.

Mergers and acquisitions have been heating up and traders don't like going into the weekend short. Today's rally looks pretty good and advancers outnumber decliners by 2 to 1. Look for a positive bias and quiet afternoon trading.

If you followed my advice last week, you have a nice portfolio of put credit spreads that are safely out of the money. I just want to sit on my positions and let time decay take care of the rest. I don't plan on being very active in the market unless we have a pullback. In that case, I will wait for support (SPY 106) and I will start selling December out of the money puts.

Daily Bulletin Continues...