Light Volume and Tight Trading Ranges Are In Store. Mantain A Bullish Bias.

Yesterday, the market was very quiet and it chopped around in a very tight range. Today, it looks like we are in for more of the same.

Building permits dropped 10.6% to their lowest level since April. That was worse than expected and a pre-open rally quickly faded when the news came out. The CPI was a little hotter than expected, but the reaction has been negligible.

The absence of news is good for bulls. It means that the current momentum and the current news (low interest rates, low inflation, solid earnings, "less bad economic figures", and strong seasonality) will prevail.

Option expiration should have a positive influence since in the money index calls greatly outnumber in the money index puts. Short covering and buy programs could get triggered on any rally.

Initial jobless claims, LEI and the Philly Fed will be released tomorrow. Based on prior numbers, I am not expecting any surprises. We should continue to see gradual improvement and that is what analysts are projecting.

As we head into next week, trading volume will subside. Thanksgiving has traditionally been bullish.

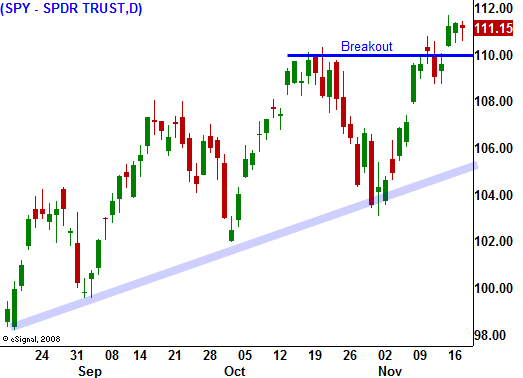

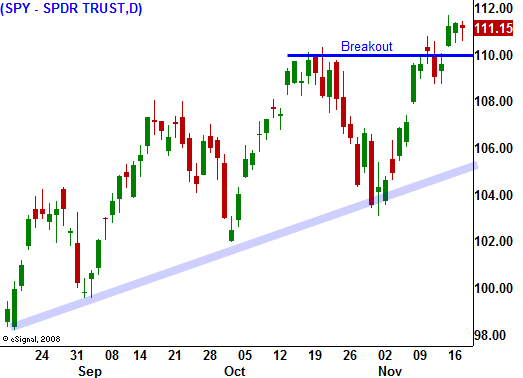

In yesterday's comments, I highlighted the importance of an intraday reversal. When we see a big spike to new highs and an intraday reversal, a warning shot will be fired. Until then, let's wait for the event and keep ourselves positioned for a rally.

I am looking for intraday trading opportunities to get long in the next week and I am in and out of positions. My core holdings are out of the money put credit spreads. I have started selling December options and I will only have 25% of my desired position on by the end of the week. I don't want to get too aggressive at this price level, but I want to take advantage of time decay and seasonal bullishness next week.

I do not believe we will see a major move today. Housing starts were very negative, but improvement was not expected. As a result, the downside should be relatively contained today. I suspect we will probe for support as we did yesterday and once it is established, we will gradually grind our way back into the closing bell. Volumes are light, keep your size small.

Daily Bulletin Continues...