Economic Numbers Have Room To Disappoint Ahead of Friday!

Last Friday, traders had planned on a quiet half day of trading. Dubai World announced that they would seek debt restructuring and they needed an extension on a $5.7 billion loan. The markets reacted with a steep decline and the S&P 500 closed 20 points lower.

First, let's put the Dubai issue into perspective. It's no secret that they overdeveloped and that commercial and residential buildings are half-empty. It was just a matter of time until loan defaults surfaced. In total, analysts have projected that this problem could reach $50-$70 billion under worst-case scenarios. That pales in comparison to the banking problems in the US. Our government lent $180 billion to AIG alone. The Dubai government has not committed to backing Dubai World even though it owns it. Abu Dhabi has a large stake in the company. They could take a larger equity stake and renegotiate terms.

In the grand scheme of things, this is a reminder that problems still exist. Eastern Europe (Latvia, Bulgaria) poses a greater problem and a handful of countries could default. That could have a domino effect in Europe. Credit issues in the United States are far from resolved and the unemployment rate continues to climb.

One out of every three homes has negative equity and 15% of all home loans are either delinquent or in foreclosure. This is the biggest asset people own and its value impacts spending habits. Banks are still taking large write-downs and the best home buying opportunity in decades has not sparked a rebound. The government is buying mortgages to artificially keep mortgage rates low. Home prices have continued to fall and there are bargains to galore. First-time homebuyers can also take advantage of an $8000 tax credit. This morning, Obama released plans to expand a program aimed at helping people remain in their homes. All of these efforts have yet to create an uptick in demand.

Last week, the GDP was revised down to 2.8% from 3.5%. In that number, we learned that corporations are making nice profits, but they are not expanding payrolls. This Friday, the Unemployment Report will be released. Initial jobless claims have improved over the last three weeks and we should get a decent number. In October, 190,000 jobs were lost and analysts expect 150,000 job losses in November. As long as we show gradual improvement, I believe the market will react positively.

Construction spending, ISM manufacturing, the ADP employment index, the Beige Book, initial claims and ISM manufacturing will also be released this week. ISM manufacturing and ISM services have been above 50 the last two months indicating economic expansion. Analysts are expecting both to stay above 50 and that would be positive for the market (if it happens).

Retail sales from Black Friday came in flat. More people shopped this year, but they spent less.

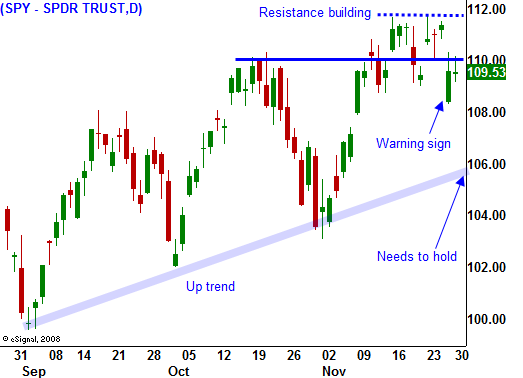

End of month fund buying is helping the market rebound today. Resistance at SPY 111.50 is building and we have not been able to break through. Asset Managers are not worried that they will miss a year-end rally and they are not aggressively buying stocks like they were a few months ago. Profit taking has set in as the market challenges the 2009 high and it will be difficult to break through.

Iran plans to expand its nuclear footprint against our will. Israel has threatened to mount an air strike as pressure builds. This threat combined with the uncertainty in Dubai could spark a dollar rally as investors seek safety. It is grossly oversold and a short squeeze could result. The short dollar trade is very overcrowded and the dollar is at a 15-year support level. A spike in the dollar would be bearish for the market.

We are in the final stages of this rally and seasonal strength will help the market tread water through year-end. As long as economic conditions improve gradually, we will fall into a trading range between SPY $102 - $112. If the recovery stalls, we could see a considerable decline in Q1 as fears of a "double dip recession" surface.

This week, I believe we will see choppy trading. Expectations are relatively high for the economic releases and there is room for disappointment. I sold some of the money call credit spreads last week and I will sell some today is the rally stalls. I'm getting a little more bearish with the market at its current level and I don't expect a breakout to new highs this year. I need to see a pullback to SPY 107 before I start selling out of the money put credit spreads. I want to distance myself from the action while the market searches for direction.

Daily Bulletin Continues...