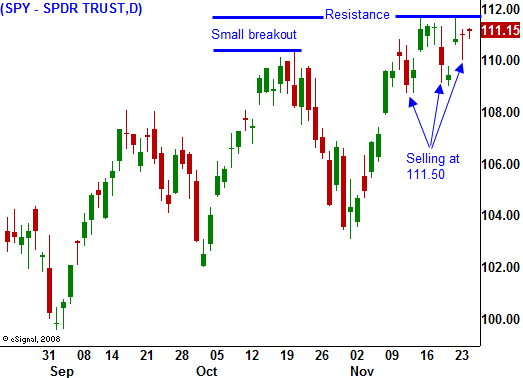

End of Month and Black Friday Could Push Us Through SPY 111.50 – Tread Carefully!

Monday, the market tried to break out to a new high after overseas markets rallied. An early surge faded quickly and the market drifted lower, giving back some of its gains. That was the third time SPY 111.50 has been tested and resistance is building.

Yesterday, the market fended off a decline after Q3 GDP was revised downward from 3.5% to 2.8%. The FDIC also released its apposite information and they fell to a negative $8.2 billion in the third quarter. The number of banks on its "problem list" rose 33% in the third quarter to its highest level in over 15 years. 124 banks have failed this year, the highest level since 1992. Given Monday's price action, I thought the table could be set for a small pullback. That did not happen and the market was able to hold its ground.

This morning, initial jobless claims fell to a seasonally adjusted 466,000. That is down from 501,000 last week. I consider this a "holiday number" and I always view them with skepticism. Initial jobless claims are volatile week to week and it is the four-week moving average that analysts watch closely. I feel this number might be inflated because employers are not likely to lay someone off during Thanksgiving. Those who were let go are likely to postpone filing until after the holiday.

The US is losing jobs at a slower rate, but we are still losing jobs. We are a long way from creating new jobs. Within the GDP number, corporate profits were up largely because companies were able to increase productivity. They have been very slow to rehire and they are waiting for bona fide signs of recovery. One out of every seven homeowners is either delinquent or in foreclosure. Banks are failing at a very high rate and our economy is not out of the woods.

Durable goods orders fell by .6% when analysts had expected a rise of .5%. Consumer spending rose by .7% when analysts were expecting a rise of .5%. Even though durable goods orders fell, consumers did spend more on autos and appliances. This could bode well for retailers this holiday season.

The next few weeks of trading will be very telling. If profit-taking sets in and the market fails to convincingly establish a new high, it will tell me that traders are selling into seasonal strength. After a 60% run-up from the March lows, they want to lock in profits.

I am seeing signs of strain and I believe we are in the final stages of this rally. A falling dollar has been bullish for the market, but that will end soon. The dollar is at long-term support levels and any further decline will result in a major breakdown. Dollar dumping would not be good for our market and it would destroy confidence.

Pharmaceuticals and gold are strong and this tells me investors are looking for safety. I have been relatively bullish to this point, but I'm growing more bearish with each week. I don't have much risk exposure and my put spreads that I sold last week are doing fine. Today and Friday I will be selling out of the money call spreads on weak stocks that have formed major resistance levels.

In light volume markets, anything can happen. The rally today is taking root and we are likely to test SPY 111.50. End of month buying and decent retail sales on "Black Friday" could push us through resistance on light volume. I might will day trade healthcare stocks. My market confidence is deteriorating and I don’t want to be long over night. If I see an intraday reversal off of a new 2009 high, I’ll know that weakness lies ahead.

May your friends and family be blessed this Thanksgiving.

Daily Bulletin Continues...