Resistance Is Building. Wait For A Shorting Opportunity!

Yesterday, the market spent the day digesting the impact of a loan default by Dubai World. From the moment the news came out last Friday, analysts were quick to put it in perspective. The worst-case scenario is a drop in the bucket relative to the financial woes we faced earlier this year. Regardless, it was a reminder that credit problems still exist.

End of month fund buying fueled a rally in the last 20 minutes of trading Monday. Overnight, strength in Asia sparked buying around the globe. Korea's exports increased by 20% in November (year over year). However, that was less than expected. HSBC conducted a purchasing managers survey in China and based on those figures analysts believe that their GDP is on track to grow 10 to 11% this year. The survey painted a brighter picture than the Chinese PMI which came out flat. The Bank of Japan increased liquidity through quantitative easing. They want to fight deflation and the program is smaller than analysts had expected. All of these news items have resulted in a major rally around the world, but these events were largely anticipated. I believe the news is already priced in and I question the run up.

Our market has spiked higher and it is once again flirting with the highs from 2009. I don't believe these events have the firepower to push us to a new high.

This morning, ISM manufacturing came in below estimates at 53.5 (55 was expected). Construction spending was flat and analysts expected a decline .5%. Pending home sales came in better than expected and they rose 3.7% when a decline of 1% was expected. All told, the releases resulted in a slight drop in the S&P 500 (four points).

Tomorrow, the ADP employment index and the Challenger Job Survey will be released. Both will give us a peek at Friday's number. Given the decent initial jobless claims numbers the last three weeks, I believe we will see improvement in the job market. Analysts are optimistic and they expect a loss of 150,000 jobs (ADP) compared to a loss of 203,000 jobs in October. We may not hit their estimates, but any substantial improvement will bode well for the market.

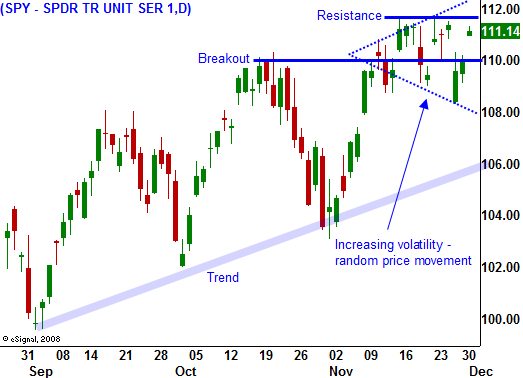

The resistance at this level is building and I am not going to chase stocks. I feel that Asset Managers are less aggressive than they were a few months ago and they are not worried about missing a year-end rally. If we breakout, it is likely to be on light volume. Once the momentum stalls, profit-taking will set in.

On Thursday, ISM services will be released. Last month, it missed estimates and it barely stayed above 50. This number is important because 80% of our economy relies on the service sector. Initial claims will also be released Thursday and they were dramatically better than expected last week. I believe that employers were reluctant to lay workers off ahead of a holiday and those who lost their jobs postponed filing for unemployment. That number has a good chance of being revised higher this week. This could create nervousness ahead of Friday's Unemployment Report.

The volume has subsided in the last month and resistance is building. Consequently, the market has moved wildly in both directions and it has been futile to try and time rallies and declines. The better approach has been to sell out of the money put spreads on pullbacks and out of the money call spreads on rallies.

In addition to the price action, there are other warning signs. Oil is the fabric to every economy and if global expansion is truly happening, we should have seen an uptick in demand. Energy prices have rallied because of the falling dollar, not because demand is rising. Transportation stocks have also provided weak guidance and while they believe the lows are in, they are not projecting higher shipping volumes. Drug stocks and gold are leading this rally. They are typically a safe place to park money (flight to safety).

After the initial surge higher, the market is struggling to hold its own. If we go into negative territory, we will have an intraday reversal, signaling a decline is close at hand. I am looking for a good entry point to get short this week. I will not be too aggressive ahead of the Unemployment Report. I will sell out of the money call spreads and on a breakdown below SPY 110 I will buy puts for a short term trade. I would not buy a breakout. The backside could be VERY slippery.

Daily Bulletin Continues...