I Will Keep My Powder Dry As I Wait For An Intraday Decline Off Of A New High!

Yesterday, the market attempted a breakout to new highs after global markets posted huge overnight gains. The news driving Asian markets was upbeat, but not unexpected. Korea's exports rose 20% in November and that was less than expected. The Bank of Japan engaged in quantitative easing to battle deflation and the magnitude of its program was less than expected. HSBC's survey of purchasing managers came in better than expected, but it was contrary to the flat PMI released by the Chinese government. The negative reaction to Dubai World's bond default was overblown and that might have justified part of the rally.

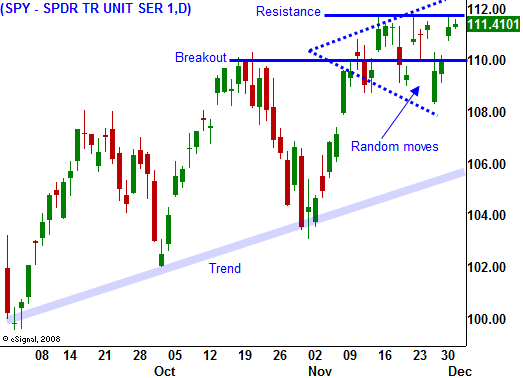

Regardless, the market was not able to penetrate resistance and once the early highs were established a tight trading range set in. In the closing 15 minutes of trading the market pulled back slightly. I still feel that overhead resistance is building and if we do break out, it will be on light volume.

This morning, the ADP employment index showed improvement, but it was lighter than expected. Private companies shed 169,000 jobs when analysts had expected a decline of 155,000 jobs. October's number was also revised lower by 8000 jobs and that is positive for the market. In a separate report conducted by Challenger, planned layoffs by companies in November shrank to the lowest level in two years. Overall, these numbers are positive, but they are not strong enough to spark a breakout.

Mortgage applications rose modestly as rates have fallen to a six-month low. The four-week moving average rose by .2%.

This afternoon, the Beige Book will be released. It should show gradual economic improvement across most regions. This is widely expected and it might have a slightly bullish impact on the market if we are breaking through SPY 111.50.

Tomorrow, ISM services will be released. Over 80% of our economic activity is tied to the service sector and this is a very important number. ISM manufacturing came in lighter than expected yesterday and the same might be true for ISM services. Last month it declined more than expected and it barely stayed above 50 (economic expansion). A light number could cause concern. Initial jobless claims also came in much better than expected last week. I feel that we could see a weak number tomorrow. Employers are reluctant to lay people off ahead of a family oriented holiday and workers are likely to postpone filing. If we do not breakout today, the resistance will build. Slightly negative news tomorrow could motivate traders to take profits ahead of Friday's number.

The expectations for a big improvement in the Unemployment Report are building. I have heard a handful of analysts talk about zero job losses in November and a possible decline in the unemployment rate. The consensus is for a loss of 120,000 jobs compared to a loss of 190,000 jobs in October. Given the optimism, there is room for disappointment.

As we enter December, seasonal strength is taking hold. Advancers outnumber decliners by 2 to 1 this morning and in the absence of news, bulls will try to stage a breakout. Asset Managers are not as aggressive as they were two months ago and they are not likely to chase stocks higher. The breakout (if it happens) will come on light volume. I might day trade stocks on the breakout, but I will be out by the close. I feel that the final stages of this rally could be near. Most bears have covered their positions long ago and short covering should be light at current levels.

The higher we go from here, the more inclined I am to buy puts. An intraday reversal off of a new high will be my signal to enter short term trade. Option implied volatilities have plummeted and puts are relatively cheap. Picking tops is often a losing proposition and you need to have strong evidence that the highs are in.

The momentum favors the upside and no one wants to get caught short in a year-end break out to new highs. Analysts are optimistic about Friday's number and we are not seeing the typical nervousness ahead of the number. Look for a positive day with the chance for a rally after the Beige Book. Tomorrow's numbers are likely to be "soft", but the market might be able to recover. If Friday's number comes in above 150,000, we are likely to see a pullback. I am selling a few out of the money call credit spreads, but my activity is light. I will not buy puts until after I see that intraday reversal that reference earlier. Keep your powder dry.

Daily Bulletin Continues...