The Higher We Go – The More Bearish I Get. Sell Call Spreads and Be Patient!

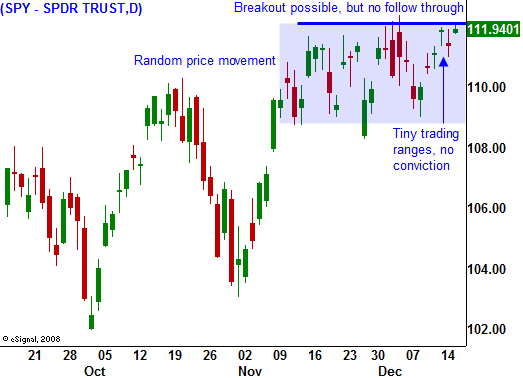

The market is right on its high of the year. Quadruple witching could push us through SPY 112 this week, but the price action has not been convincing.

We have fallen into a pattern where the market opens marginally higher (five S&P 500 points) and it falls into a very tight trading range the rest of the day. This rally has been very stealth and it is not displaying the type of strength that would lead to a sustained rally. Ideally, bulls would like to see an early decline with buying the entire day and a close near the high on solid volume. We aren't seeing that type of trading.

Wall Street would love to have the market finish the year right where it stands today. Hefty bonus checks would get cut and 2010 would start with optimism. Even a small amount of buying can prop up this market.

Yesterday, a hotter than expected PPI did not generate any selling pressure. Inflation would result in higher interest rates and in this fragile recovery phase, it could send our economy back into a recession. Those concerns will resurface when seasonal strength passes. This morning, CPI rose more than expected and the market took the number in stride.

It will be interesting to see how the Fed addresses inflation. They have been forecasting a decline and that has allowed them to maintain their dovish policy. Employment has also improved dramatically since their last meeting and will see if their rhetoric changes. I don't believe it will. They want to keep interest rates as low as possible for as long as possible. The FOMC statements this afternoon should receive a positive reaction if they are unchanged. The market has a good head of steam today and this could spark a breakout.

Call open interest in index options is high and that could spark expiration related buy programs. Traders will be looking for a gradual move higher so that they can leg out of hedged positions. This will "goose" the market higher. While the breakout might look good on a chart, this is a manufactured rally.

I feel that the momentum has stalled and profit-taking will be heavy at higher levels. Any breakout will be contained and sellers will lighten up by selling into strength. They will let the market run its course before they start hitting bids.

Banks have been raising equity like mad in the last week. Between Bank of America, Citigroup and Wells Fargo, almost $50 billion has been raised. The market has been able to absorb the new supply of stock and this is a good sign. Taxpayer money has been replaced with private equity and that will make politicians look good. I feel that financial institutions are rushing to secure capital while the window of opportunity still exists.

We need to keep a close eye on Europe. Major credit concerns are starting to surface. Problems in the PIIGS (Portugal, Ireland, Italy, Greece and Spain) can easily spread through Europe. The Irish government could easily own 50% of its largest banks since they are in dire need of capital. Greece was downgraded last week and Spain was put on a credit watch. Latvia and Bulgaria are on the brink of financial collapse. Yesterday, we learned that Austria nationalized one of its largest banks and a second is near collapse. Individually, these problems can be dismissed. Collectively, they are material and they could have a ripple effect.

Yesterday, we learned that US credit card defaults rose. We know that 15% of all mortgages in the US are either delinquent or in foreclosure. Consumer credit problems are far from over. States have a $300 billion deficit and this is a direct violation of the U.S. Constitution. State taxes will have to increase next year so that they can pay down debt.

The same holds true for our government. A former U.S. Treasury Comptroller estimates that our national debt stands at $56 trillion if you include all of our future obligations (Social Security, pensions, Medicare). In less than 10 years, 100% of our national budget will go to interest payments on our national debt and entitlement (Social Security, Medicare). There will be nothing left over for all of our other needs. This is not a problem for future generations; our debt needs to be addressed now. Instead, the government wants to pay you to caulk your windows (“cash for caulkers” program)

The higher the market moves, the more bearish I get. I have closed out my put positions for a loss and I will hang on to my out of the money call credit spreads. With only a few days left until expiration, they are safely out of the money. I have started selling January out of the money call credit spreads.

A year ago, the market was priced for disaster. Now it is priced for perfection. The VIX is near a two-year low and fear has been replaced with confidence. China and other emerging markets need the US, Europe and Japan. The tail will not wag the dog and emerging markets will not pull the wealthiest nations out of this recession.

I feel that we are one or two negative news events away from major decline. They will have to be material and the source is likely to be deteriorating economic growth or credit defaults. I don't know when that news might hit, but the market is on shaky footing.

Sell out of the money call spreads and be patient. Your put buying opportunity is close.

Daily Bulletin Continues...