A Good Start To The New Year – Expectations Are High For Friday’s Number!

The market is starting the New Year off on a positive note. This is the ninth consecutive rally we have seen on Monday and it was helped by overseas markets, decent economic news and M&A activity.

China's PMI rose to 56.1 in December (up from 55.7) to the highest level since April 2004. This lifted Asian markets and it fueled commodity stocks.

The economic news was good in the US as well. Manufacturing grew a fifth consecutive month and ISM rose to 55.9 in December, up from 53.6 in November. A number above 50 indicates economic expansion. The consensus estimate was 54.3 and the number came in considerably better. Construction spending was down .6% and that was largely in line with expectations.

This will be a busy week filled with economic releases. Factory orders, pending home sales, the ADP employment index, ISM services, initial claims and the Unemployment Report will be released. Many analysts are looking for the first positive employment number in two years and the highest estimate I've heard is for job growth of 40,000. This would certainly boost optimism and Obama is likely to blow his own horn. Corporations have cut to the quick and they have been hiring more and more temporary help. Productivity has been stretched to the point where they need to consider adding staff. During the holidays employers are less likely to fire workers and those who are laid off tend to postpone filing for unemployment. Taking these factors into consideration, I feel this particular Unemployment Report could be positive.

However, I don't want to sound like I am turning bullish. I still feel that jobs will be very slow to recover. International companies will expand overseas operations first. Lower wages and lower health insurance costs make those workers more attractive. State and local governments will cut back spending (payrolls) and increased taxes to balance their budgets.

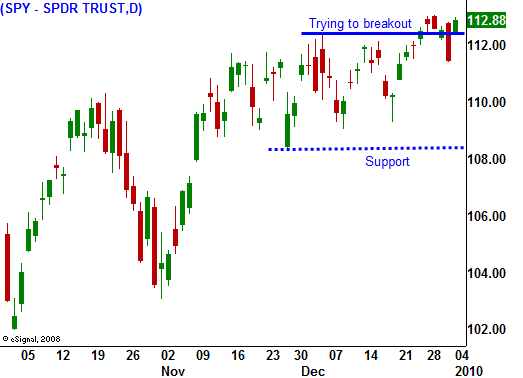

Today's rally feels much bigger than it actually is. Last Thursday, the S&P 500 fell five points during normal trading hours. After hours, it fell another six points. If you subtract that loss from today's gains, the futures are up about six points. We are just above the high from last week (SPY 113.15). It is possible the market will continue to grind higher, but profit-taking will keep any rally contained.

The expectations for a great employment number are "baked in" and the market might not rally much even if we see job growth. A job recovery would push interest rates higher and that fear will also keep the rally in check.

The "Santa Claus Rally" ends tomorrow and it looks like we will see marginal gains. End of month fund buying will run its course tomorrow and then the focus will shift to jobs.

The market is trying to breakout of a trading range and the gains from here will be hard-fought. A full-blown recovery is priced in and any news to the contrary will spark a swift decline. Trading volumes are still likely to be light this week and I am keeping my powder dry to a large degree. I stopped selling out of the money call spreads two weeks ago and they are in decent shape. Option implied volatilities are at an 18 month low and it doesn't make sense to sell premium. I am a put buyer at this stage and I am patiently waiting for signs that this rally has run out of steam. I will start buying puts on close below SPY 112. I won't add unless I see follow through and I will get more aggressive on the breakdown below SPY 108. This could be a quiet week for me and I need to be patient. Newsletter writers are overwhelmingly bullish and the market will eventually flush out this optimism.

Daily Bulletin Continues...