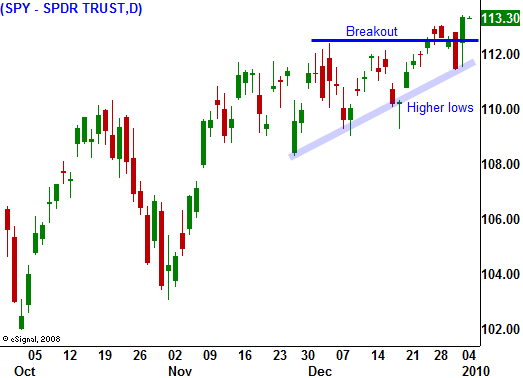

The Breakout Has Not Been Convincing – Let It Run – Line Up Shorts!

Yesterday, the market surged higher on the first trading day of the new year. Strength in overseas markets, better-than-expected economic news and M&A activity fueled the rally.

While impressive, the gains barely established a new relative high. The market had declined heading into year end and Monday's move recouped those losses. The path of least resistance is clearly higher and Santa Claus did visit Wall Street. This is the last day of that trading anomaly and economic releases this week will give traders something to chew on.

This morning, factory orders rose 1.1% and that was better than the .5% analysts expected. Inventories have been drawn down and businesses are starting to replenish them. The pending home sales index dropped 16% in November as homebuyers rushed to take advantage of the tax credit. These two releases are minor compared to the announcements we will get tomorrow. ADP will release its employment index and it will give us a peek at Friday's Unemployment Report. Analysts are extremely bullish and they are looking for job growth for the first time in two years. As I outlined yesterday, I believe we will get a good number, but those results are already priced into the market. As a result, I don’t believe we will see much of a rally. In fact, worries of higher interest rates could spark a sell off if we see job growth. ISM services will also be released tomorrow. Over 80% of our economic activity is tied to the service sector and this is a very important number. For two consecutive months, it has fallen below expectations. Last month it came in at 48.7, indicating economic contraction. Another bad number would weigh on the market. Analysts are expecting 50.5.

I believe the jobs picture has room to improve during Q1. The government still has some stimulus money to spend and companies have stopped laying people off. As the year progresses, organic growth will have to replace stimulus. By then, state and local governments will be trimming staff to balance budgets and recover from huge deficits. Consumers are gradually opening their wallets, but they are not resuming their reckless spending habits. Spending drives almost 70% of our GDP and I feel most people will respect last year’s warning shot. That means a slow recovery.

Personal balance sheets are a mess. One in three homes has negative equity and one out of every six homes is either delinquent on payments or is in foreclosure. The average baby boomer has less than $80k saved and they are already starting to retire. The last spending boom was created by the Fed when they lowered rates after 9/11. Homeowners refinanced and took out home equity loans to create “found money”. That bullet has been fired and I can’t see where this next wave of spending is going to come from - especially with a 10% unemployment rate.

Stocks are priced for a full-blown recovery and I am not that optimistic. A handful of bad economic numbers could topple this market. Credit issues in Europe could also spark a wave of selling if conditions worsen. Resistance at this level is fairly strong and we are not seeing panic buying. The rally has been contained as some investors take profits. It is premature to short this market and the gradual grind higher can be like Chinese water torture. This is a good time to line up weak stocks that have rallied with a market. Draw horizontal support lines and uptrend lines. Place GTC orders to buy puts on the stocks when those levels are breached. Once the market turns, you won't have time to execute all of the trades and you need to be ready ahead of time. If the market continues to move higher, reevaluate your orders. This is a time to be patient.

I am not looking for a major top, just a sharp 5% decline. A more sustained decline will only come as economic conditions continue to deteriorate over an extended period of time. That news should come in late in Q2. Only the fear of a double dip recession can force this market to rollover.

Daily Bulletin Continues...