Reaction To CSX, IBM and Banks Will Be Very Telling. We’ll See If There Is Room To Run.

Last Friday, the market showed some weakness when it sold off on decent news. Intel beat earnings estimates and it was a little light on revenue. J.P. Morgan Chase also beat estimates, but loan write-downs were greater than expected. The CPI was benign and inflation only rose by .1%. The numbers were good, but once the selling momentum gained traction, the market declined steadily throughout the day.

This morning, overseas weakness pushed prices lower on the opening bell. They quickly recovered and we now have 12 consecutive rallies on the first trading day of the week. News that Kraft is buying Cadbury helped to restore confidence.

Earnings season will really take off this week. Banks will dominate the scene and this morning Citigroup hit estimates. The stock is flat after testing the downside early on. Before tomorrow's open, we will hear from Bank of New York, Marshall & Illsley, Morgan Stanley, Northern Trust, State Street, U.S. Bancorp and Wells Fargo. This round of earnings will set the table for financial stocks. The sector has lagged and I thought there might be more upside potential. After the reaction to J.P. Morgan Chase's number, I'm not so sure.

IBM will announce earnings after the close. They have consistently beat estimates and guidance has been very positive. I would expect more of the same. We'll see if all of the good news is already priced in. Tech stocks have been leading the market higher and I believe there is room for disappointment. EBay, Seagate, F5 Networks, Advanced Micro Devices, and Google will announce this week.

After the close we will hear from CSX. I have not seen an uptick in transportation activity and until I do, I will question this supposed economic recovery. Last quarter, revenues were down 23%. Rails have been fairly strong because Berkshire Hathaway bought Burlington Northern. This was a very long-term investment and I believe this group could disappoint.

Tomorrow, the PPI will be released. This is perhaps the most important economic number of the week. Commodity prices have been moving higher and producers might be feeling the pinch. Inflation usually starts at the manufacturing level and it works its way up to the consumer as higher prices are passed along. Analysts are expecting PPI to come in at 0% after being up 1.8% last month. An uptick in inflation will raise fears of higher interest rates.

Last quarter, stocks rallied ahead of earnings and they pushed slightly higher during the first two weeks. Then, they hit a brick wall and share prices declined after earnings were released. I feel that same pattern could set in this quarter. Stocks are pricing in fantastic results and year-over-year earnings could be up 200% on the S&P 500. Keep in mind that last year's results were horrible and that companies have slashed expenses down to the bone. From this point on, earnings will not grow without an increase in revenues.

I believe large companies will add international staff in emerging markets before they rehire in the US. Labor costs are cheaper there and the growth potential is greater. Small business sentiment has declined 2 months in a row and they account for 50% of our nation's employment. They are not adding staff. This will be reflected in weekly initial jobless claims numbers. If they start to creep higher and traders suspect that a second bad Unemployment Report lies ahead, they will sell first and ask questions later. This scenario lines up with my two week timeline.

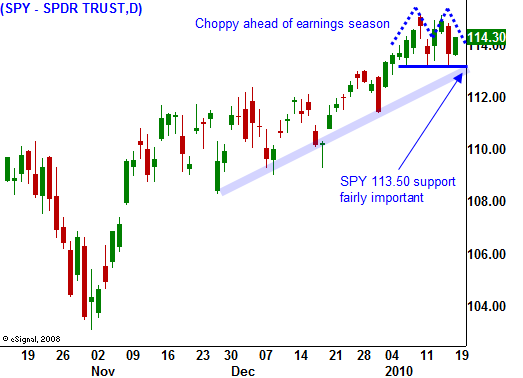

I am lining up shorting opportunities. I have my list of stocks and I want to see the market's reaction to earnings. If a company gives lackluster guidance and the stock breaks technical support, I will go short. I don't want to get too aggressive until the SPY closes below 113.50 and 112.

Look for slightly higher prices during the next week and a half and a firm resistance level after that. Be patient and wait for a breakdown.

Daily Bulletin Continues...