Volatility Creeps Back Into the Market As Traders “Sell The News”. Watch SPY $113.50

Yesterday, the market rallied sharply on the first trading day of the week and it erased all of the damage that was done last Friday. By the end of the day, the S&P 500 was near a new relative high.

On the political front, Republican Scott Brown was elected in Massachusetts. Democrats no longer have the 60 seats needed to avoid filibustering. More importantly, Americans have voiced their displeasure with the way the country is being run. This should send a clear message to Democrats and we will see how this impacts their actions ahead of November’s elections.

The economic news was rather weak. The PPI rose .2% when analysts had expected a flat number. If prices start to rise, we will see rising interest rates. Housing starts fell 4% and that was worse than expected. Tomorrow's initial jobless claims number is fairly important. The Unemployment Report missed expectations two weeks ago and last week's initial jobless claims number was higher than expected. If we see more than 450,000 claims being filed tomorrow, the market will have a negative reaction. Gradual improvement in the unemployment scene has helped this market rally. If jobs are not created, fears of a double dip recession will surface. LEI and the Philly Fed will also be released tomorrow but they will have a smaller impact. Both numbers were decent last month.

There were major earnings announcements yesterday after the close. IBM beat expectations, but not by a wide enough margin to spark buying. The stock is down after the announcement. CSX, a major railroad, posted weak earnings. Excluding one-time items, net income was down 16% and revenues were down 13%. Guidance was also weak and I have to question the supposed economic recovery. If conditions are improving, why haven't shipping volumes rebounded?

Some of the nation's largest banks also released earnings this morning. For the most part, they are flat to slightly higher after posting results. I thought we might see this sector push the market higher. After seeing the market’s reaction, that rally is not likely to happen. Large amounts of stock have been issued to raise capital and that has diluted shareholder value. Write-downs also continue to plague banks.

After the close today, we will hear from a number of tech stocks. They included eBay, F5 Networks, Seagate and Xilinx. These stocks have rallied and great results are priced in. The overnight action will give us an idea of just how much gas (if any) is left in the NASDAQ tank. Before tomorrow's open, we will hear from a number of financial institutions. Comerica, Fifth Third Bank, Goldman Sachs, Legg Mason and PNC Bank round out the list. Investment banking is likely to save the day for Goldman Sachs and I feel they will post a strong number. The other financial institutions are likely to trade flat to slightly higher after releasing. All told, I would have to give earnings a slightly negative bias heading into tomorrow's open.

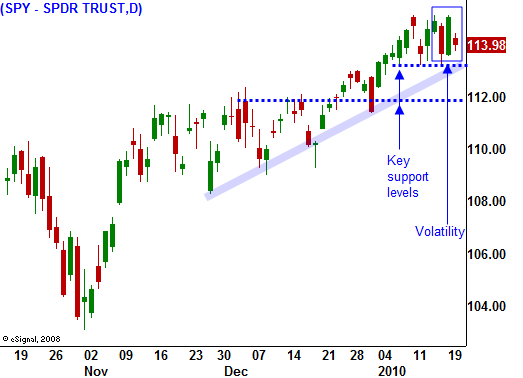

The market has given back yesterday's gains in the S&P 500 is down 14 points in early trading. Traders are selling the news and profit-taking is back in force. If the market closes SPY $113.50, I will buy puts. That is a significant short-term support level and if it falls, SPY 112 will be tested. If the market takes out that support level, the selling pressure will increase.

I feel we are close to a breakdown, but I want to temper my bearishness. In order to see sustained selling, we need a dose of bad news. That could come in the form of a bad Unemployment Report, higher inflation, new credit concerns in Europe or number of other events. Earnings should be decent and I don't believe that pricey valuations alone will topple this market. If the guidance is weak, that's another story.

Line up your shorts, identify support levels and buy puts when they are breached.

Daily Bulletin Continues...