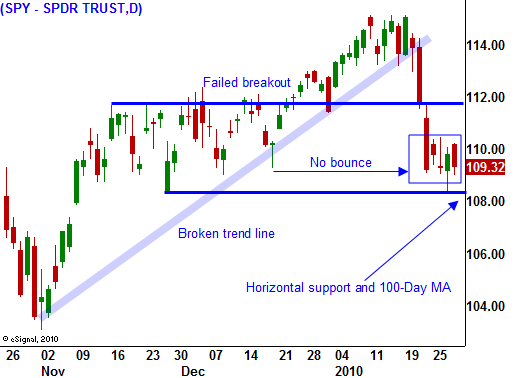

The Market Is Testing Major Support At SPY 108 – If We Close Below It – GET SHORT!

This week, the market has continued to struggle. It has broken the uptrend line from March and it has broken horizontal support. If it breaks below SPY 108, we will see another leg down.

Only a few weeks ago, we saw excessive optimism and that bullishness needed to be flushed out of the market. Almost every analyst on CNBC was bullish, 80% of all newsletter writers were bullish, option implied volatilities were near 18-month lows indicating a high level of confidence and call option volume was extremely high the week before expiration. When sentiment reaches these heights, sharp declines occur. Bullish speculators panic and they start hitting bids to get out of positions.

Profit-taking has also accelerated and many investors are heading for the sidelines. The market has rallied 65% from its March low and portfolios have rebounded nicely from year ago levels. People don't want to relive that moment and they are prudently reducing risk.

This morning, initial jobless claims were released. They came in at 470,000 when analysts were looking for 450,000. This is the third week in a row that unemployment has disappointed. The market will get nervous ahead of next week's Unemployment Report. It can shoulder one bad number, but two bad reports in a row would raise fear of a double dip recession.

The job situation is so critical that it was a focal point for last night's State of the Union Address. Obama needed to reassure Americans that it was his number one priority. He will be asking Congress for another stimulus plan. This one includes the build out of high-speed rails. Given the government's great success with Amtrak (not), this seems like a great use of taxpayer money. Where are all of these travelers that need high speed rail? Not more than a couple of days ago, he referenced a three-year spending freeze to help reduce the deficit. How is another stimulus plan going to help us balance our budget?

Each year, the government spends 75% of its budget on Social Security, entitlement (Medicare, pensions) and defense. These are the areas where dramatic savings can be realized and these are the areas that must be addressed. Unfortunately, they will be unscathed. In 10 years, 100% of our national budget will be spent on interest on our national debt and Social Security/entitlement. We are headed down a very dark path.

Europe has similar problems and I have continually referenced Portugal, Ireland, Italy, Greece and Spain (PIIGS) as a source of weakness. This morning, Standard & Poor's hinted that England is also heading down a very slippery slope. We have already seen a multitude of downgrades in Europe and bonds are pricing in a risk premium. The European Central Bank has already stated that it is not going to bail out

EU members. Greece held a bond auction last weekend and it was successful. However, bond prices in Greece have skyrocketed by more than 50 basis points this week and the appetite for additional auctions will be low. The cost of capital has increased dramatically this week.

A month ago, it looked like Ben Bernanke was sure to get reappointed. He navigated us through the toughest financial time since the Great Depression. Unfortunately, Congress wants to get involved and they are more interested in placing blame than they are re-electing a solid Fed Chairman. From the government, to the states, to municipalities, to individual Americans, we have all spent beyond our means for decades. That is the problem and we are all at fault. Now we need to save and pay our debts.

Durable goods orders were much weaker than expected and the hopes for a strong GDP remain. Analysts are looking for a gain of 4.5% in Q4. That number will be released tomorrow and anything above 4.2% should be well received.

Earnings are coming in strong, but that is largely priced in to the market. Cyclical stocks have been providing weak guidance and the supposed economic recovery is being questioned. These stocks have gotten way ahead of themselves and they represent good shorting opportunities.

The market is falling apart this morning and as of this writing, critical support at SPY 108 is being tested. A breakdown would increase the selling pressure. Friday's have tended to be bullish since 12 of the last Monday's have traded higher. End of month fund buying should also be supporting this market and it is not. The tide is turning and traders do not want to go home long. We have seen the highs for the next 10 months and it is time to sell rallies.

Buy puts on stocks that have broken technical support and add to positions if the SPY closes below 108. Daily Report subscribers, short stocks that are near the top of the bearish watch list in the Live Update Table.

Daily Bulletin Continues...