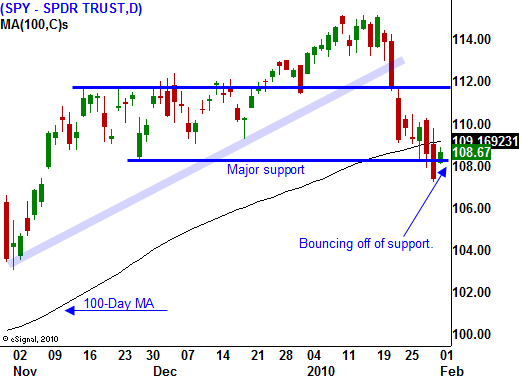

The Market Is Oversold and It Is Bouncing Off Of Major Support – Stay Short If SPY Is Under $112.

Last week, the market continued its slide. For the month of January, the market was down 3.5%. Historically we know that January's price action is a good indicator for the first six months of the year.

The market hates uncertainty and a number of factors are weighing on it. Perhaps the most important is the European credit situation. A number of smaller EU members are sinking deeper and deeper into debt and default is a real possibility. The European Central Bank has already stated that it will not bail out Greece. This was a warning to all other countries that are running huge deficits.

Greece successfully held a bond auction and it had a fairly strong bid to cover of three indicating good demand. However, a few days after the auction, Greek bond yields spiked and a huge risk premium was priced in. This means the appetite for future bond issues will be light and the cost of capital will be high. This event sparked selling in an already vulnerable market.

Stocks had run up in early January and optimism was at excessively high levels. Newsletter writers and analysts were overwhelmingly bullish (80%). Call volumes spiked to levels not seen in months and option implied volatilities collapsed to 18-month lows. This optimism needed to be flushed out of the market and it caused the first wave of selling.

Political uncertainty in the US also fanned the flames. From one week to the next, new stimulus plans, regulations, programs and restrictions have been proposed. It's hard for companies to operate in this environment. Those who are making money worry that profits will be stripped away by new taxes. Health insurers and oil companies are vulnerable. US corporations have been fiscally responsible and it has taken them 10 years to beef up balance sheets. S&P 500 companies collectively have $820 billion in cash and it's just a matter of time until the government taps into that resource. Our government blew through twice that amount of money in one short year and the budget for 2010 projects another $1.5 trillion deficit.

Social Security, entitlement (Medicare, government pensions) and defense spending are breaking our back. These items account for 75% of our nation's budget, yet they are not being considered for cost cuts. Instead, we are focusing on tiny cuts that won't remotely cover the cost of a new stimulus plan. Add a national health insurance plan to the equation and massive tax increases will have to be imposed to cover massive deficits.

Earnings have been decent, but the guidance is a problem. Cyclical companies have back loaded 2010 results and the first two months are projected to be slow. I question the entire global recovery theory and I believe we will see major signs of stress in the next six months. They will not appear quickly, this will take a little time. Stimulus spending still needs to run its course. Once that impetus fades, organic growth will fail to materialize. That is when we gradually start to sink lower. This morning we heard that construction spending fell 1.2% when analysts had expected a decline of .5%. November's number was also revised lower. Businesses are not reinvesting and they will not until they see an uptick in demand.

The economic news is light tomorrow, but Wednesday we get the ADP employment index and ISM services. Those are two big numbers and they will impact trading. Initial jobless claims have been weak for 3 consecutive weeks and we might be set up for a disappointing Unemployment Report.

Last Friday's market reaction shocked me and I did not expect a reversal. Even more surprising was the penetration of a major support level after GDP grew 5.7% in Q4. Today, the market has not been able to spark a short squeeze. Bears are confidently hanging on to positions and profit takers are selling into rallies.

The market is oversold and we can expect a bounce, perhaps on the actual unemployment number Friday. Until then, I would stay short provided the SPY closes below $112. Look for opportunities to take partial profits on short positions before Friday’s number.

Daily Bulletin Continues...