Friday’s Intraday Reversal Should Set Up A Rally – Don’t Trade It – It Won’t Last!

Last week, the market staged a huge selloff that pushed it below major support levels. Earnings have been decent, but that was already priced into the market and Q1 guidance has been cautious. Economic releases have been fairly good, and gradual economic growth is still plausible. Credit is the big concern as the situation worsens in Europe.

Greece and Spain have both had their credit ratings downgraded. Portugal tried to auction short-term bills last week and they could not generate enough demand to fill their needs. Portugal, Italy, Ireland, Greece, Spain, Latvia, Lithuania and Bulgaria are the problem spots. The rest of Europe is also treading on thin ice. Burdened with massive deficits of their own, the "stronger" countries are not in a position to bail out weaker EU members.

Austria has already nationalized one of its largest banks and another is perilously close to the same fate. The credit crisis has spread and major banks in France, Germany, England and Switzerland have a great deal of risk exposure. The ECB is oblivious and they aren’t grasping the gravity of the situation. They could have calmed nerves this weekend by holding an emergency meeting – they did not. They need to draw up contingency plans to restore confidence.

Unfortunately, the European Central Bank already stated that it would not bail out Greece. That spooked investors and Greek bond yields skyrocketed as risk was priced in. Their government plans massive cuts to try and get their budget balanced in three years. Labor unions in this socialist country don't like the sound of cutbacks and they plan to go on strike.

As Greece and other European countries cut their spending, economic conditions will contract. The best case scenario is that Europe goes into a prolonged recession. The worst-case scenario is a credit crisis that starts in a handful of countries and snowballs into the global banking system. Bad loan decisions and excessive spending must run their course. In the last year, risk has simply been shifted from the private sector to the public sector. Governments have deeper pockets and they should be able to shoulder the risk during hard times. However, decades of increasing debt are catching up with them. The old adage "the bigger they are, the harder they fall" applies here.

Over the weekend, the IMF met in Canada. While the credit situation was discussed, there were not any solutions.

This potential crisis will keep a lid on the market. You can't predict when the first major event is going to rattle the financial markets, but I feel it is only months away. If investors back away from sovereign debt, the problem will escalate quickly.

The US is in a similar situation. With extremely high debt levels of our own, additional stimulus will put us even further in the hole.

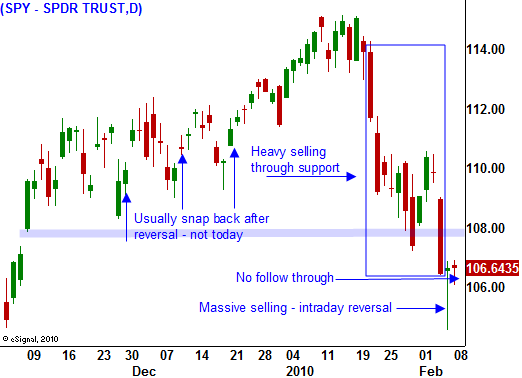

I believe you need to sell the rallies once they stall. Last Friday, the market staged an intraday reversal after making a new relative low. As you can see in today's chart, those patterns have represented buying opportunities. Previously, each of those rallies took place while the market was still in an uptrend. That trend has been broken and greater caution needs to be used. This snapback is likely to run out of steam soon.

Earnings season is winding down and the economic releases this week are very light. They include wholesale inventories, trade balance, initial claims, retail sales and consumer sentiment with most of these releases hitting Thursday and Friday.

The gambler in me wants to trade this rally (don’t do it). The trader in me tells me to be patient and to wait for an opportunity to get short. My trading voice always wins out and I will start placing more put orders. When the big hurt comes, I want to be ready at a moment’s notice. I hope we do get a rally. It will reduce option implied volatilities and I can by my puts cheaper. I can also use the recent lows as a trigger to get back in. As the market rallies, I will raise my trigger points.

The credit crisis in Europe is dire. Poor leadership at the head of the ECB and a lack of unity within the EU will cause the situation to unravel quickly. Sell into this rally once it stalls. A breakdown below SPY 106 would be bearish.

Daily Bulletin Continues...