Be Patient and Wait For the Next Shorting Opportunity!

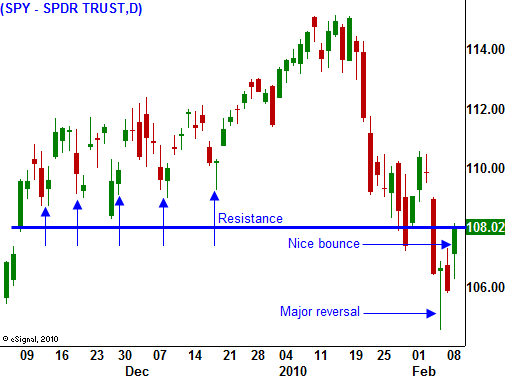

Yesterday, the market tried to rebound after Friday's intraday reversal. These are key technical patterns and they have produced nice rallies in the last six months. However, the market was in a strong uptrend back then and now that support is gone.

By the close of trading Monday, the market had slipped five points on the S&P 500 and the technicals looked weak. This morning, the market has tried to rebound and the price action has been whippy. Rumors circulated that the EU was going to bail out Greece.

This would certainly restore some confidence in the market, but it ignores a bigger problem. Europe's credit situation is not isolated to one country. There are at least 10 that pose the threat of default. Individually, they are not enough to threaten the EU. Collectively, they represent a huge portion of Europe's GDP. The ECB does not have written procedures in place to address default and they don't seem to be in a hurry to draft a plan.

Global financial markets are intertwined. We saw that last year when the US decided to let Bear Stearns and Lehman fail. In a matter of hours, credit markets locked up and banks stopped conducting business with each other. Financial institutions have substantial investments in foreign bonds and when a country fails the impact is widespread.

The US is in a similar situation, but we have a centralized banking system in place. Many states are running huge deficits and they might need bailouts. They are a microcosm of what's happening to our nation and collectively, they are $300 billion in the red. Tax receipts are down and expenses are escalating. If drastic measures are taken to balance the budget, the economy will contract and there will be hardship. If we continue to print money (spend our way out), the pain will be postponed but it will be unbearable when it happens.

If printing money is the solution, why do any of us have to work? We should just run the presses and live happily ever after. We all know that this plan cannot work long-term, but we have been doing it for 30 years. If you spend beyond your means, sooner or later you will pay for your mistakes. The US and Europe are quickly moving closer to their breaking point. The market “shocks” will be more and more severe in the next few years.

Like Greeks, Americans do not like pain. We don’t want to hear that social programs are going to be cut and that taxes are going up. The politician that runs on this platform will never get elected. The guy who promises health, happiness and a new car every garage will take office.

The economic news this week is very light. Initial claims and retail sales will be the highlight of the week and they will be released Thursday. Earnings are starting to slow down and they're not having much of an impact. The market will try to rebound from a deeply oversold condition. I don't believe this rally will have much momentum and is likely to stall out. This will set up an excellent shorting opportunity.

The market has broken major technical support and fear has returned. Europe will not draft a permanent solution until the credit problem is dire. They will put a Band-Aid on Greece and hope for the best. The smart money knows that the credit crisis has not been resolved. It has simply shifted from the private sector over to the public sector and now deep pocket governments are struggling to tread water.

These snapback rallies can be fierce. Let them run their course and then get short when they run out of steam.

Daily Bulletin Continues...