Household Debt Will Prevent An Economic Recovery – Consumption 70% of GDP!

The market staged a nice rally last week and it challenged the highest of the year. From a valuation standpoint, the market is attractive. Corporations have slashed expenses and profits are decent. After the tech bubble 10 years ago, companies reduced debt and strengthen balance sheets. Low interest rates also make equities and attractive investment alternative.

Unfortunately, as we saw last year, credit can spoil this party. Debt levels have skyrocketed around the world and some countries are perilously close to default. Europe is in dire straits, but the US is close behind.

Recently, I have written about our government's extreme debt. Today, I want to focus on household (personal) debt in the US. Consumption accounts for more than 70% of our economic growth and personal balance sheets play an important role in discretionary spending.

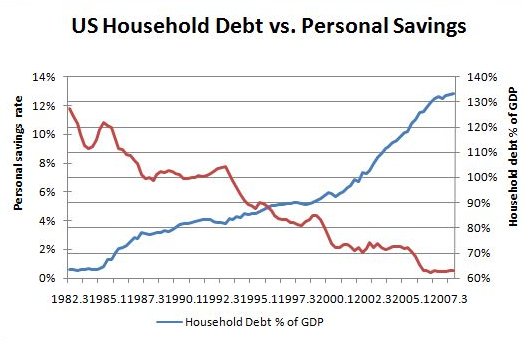

In the chart below, you can see how the personal savings rate has declined over the last 30 years. In a recent survey I read that 30% of all baby boomers (ages 45 to 62) are not seriously saving for retirement. On average they have saved less than $38,000 excluding pensions, homes and Social Security. For those that do have qualified retirement savings plans, the average baby boomer has $88,000 saved. That will yield less than $5000 per year of retirement income.

Baby boomers are already retiring and they will have to dramatically increase their savings and decrease their spending. Most companies have retirement savings plans where the funds can be automatically deducted from paychecks. This makes it very convenient to “salt money away”. Corporations often match contributions, making this a very attractive investment. There are also tax advantages to saving for retirement. Given all of these incentives, it's safe to assume that these accounts represent the greatest portion of their savings.

With all of the advantages of retirement accounts, I do not believe that baby boomers have other large investment accounts. As for their other assets, their homes are considered their “nest egg”. Unfortunately, one out of every three homes has negative equity and this is not a huge source of potential wealth. Even if you do sell your house and tap into that equity, you still have to live somewhere. In short, I do not believe that asset growth has kept pace with debt.

As the economy grows, you would expect household debt to grow in absolute dollars. Economists understand this and they normalize this statistic by measuring household debt as a percentage of GDP. In the chart below, you can see how the debt level has increased dramatically in the last 10 years in both absolute and percentage terms.

.

.

.

.

Americans have mimicked the government and they have gone on a 30-year spending spree. We have taken out home equity loans and we refinance our mortgages at the lowest rate in 50 years after 9/11. This "stimulus" fueled the last economic boom and that final bullet has been fired. That is why low interest rates in 2008 - 2009 will not result in another big economic boom. That money has already been spent.

Federal, state, municipal and household debt is at an extreme level and this fish stinks from the head down. When a credit crisis strikes, stock valuations mean little. Financial institutions, traders and investors have to liquidate positions to raise cash. Businesses can't access capital to meet short-term obligations and commerce comes to a screeching halt.

This is a time to pay down debt and curb spending. Get your own balance sheets in order and be prepared to short this market. I don't know when the big hurt will come, but I expect there will be a number of mini crashes before the big one comes. With each decline, the government will make a halfhearted attempt to restore confidence. Traders will realize that the Fed has also fired all of their bullets and a big drop will follow.

As bad as the situation is in the US, debt levels are even worse in Europe. Thirty years of reckless spending will not be resolved in one year. Like fools, our leaders believe this problem can be solved by spending more money.

The market is down a little today. It has been particularly strong during the recent rally and I don't want to jump the gun on short positions. When the SPY closes below 112, I will buy puts. When the SPY closes below 108, I will add aggressively. If the market continues to rally, I will sell out of the money put credit spreads to generate income, but these positions will be relatively small. As the market moves higher, I will raise the entry points for my put purchases.

The economic numbers this week should be "friendly". The FOMC statement could have a bearish impact since additional measures could be taken to unwind quantitative easing. This is the first Monday in months where the market has traded lower and that could be a bearish sign. Expect a choppy week as the market tests resistance at the high of the year.

.

.

Americans have mimicked the government and they have gone on a 30-year spending spree. We have taken out home equity loans and we refinance our mortgages at the lowest rate in 50 years after 9/11. This "stimulus" fueled the last economic boom and that final bullet has been fired. That is why low interest rates in 2008 - 2009 will not result in another big economic boom. That money has already been spent.

Federal, state, municipal and household debt is at an extreme level and this fish stinks from the head down. When a credit crisis strikes, stock valuations mean little. Financial institutions, traders and investors have to liquidate positions to raise cash. Businesses can't access capital to meet short-term obligations and commerce comes to a screeching halt.

This is a time to pay down debt and curb spending. Get your own balance sheets in order and be prepared to short this market. I don't know when the big hurt will come, but I expect there will be a number of mini crashes before the big one comes. With each decline, the government will make a halfhearted attempt to restore confidence. Traders will realize that the Fed has also fired all of their bullets and a big drop will follow.

As bad as the situation is in the US, debt levels are even worse in Europe. Thirty years of reckless spending will not be resolved in one year. Like fools, our leaders believe this problem can be solved by spending more money.

The market is down a little today. It has been particularly strong during the recent rally and I don't want to jump the gun on short positions. When the SPY closes below 112, I will buy puts. When the SPY closes below 108, I will add aggressively. If the market continues to rally, I will sell out of the money put credit spreads to generate income, but these positions will be relatively small. As the market moves higher, I will raise the entry points for my put purchases.

The economic numbers this week should be "friendly". The FOMC statement could have a bearish impact since additional measures could be taken to unwind quantitative easing. This is the first Monday in months where the market has traded lower and that could be a bearish sign. Expect a choppy week as the market tests resistance at the high of the year.

.

.

Americans have mimicked the government and they have gone on a 30-year spending spree. We have taken out home equity loans and we refinance our mortgages at the lowest rate in 50 years after 9/11. This "stimulus" fueled the last economic boom and that final bullet has been fired. That is why low interest rates in 2008 - 2009 will not result in another big economic boom. That money has already been spent.

Federal, state, municipal and household debt is at an extreme level and this fish stinks from the head down. When a credit crisis strikes, stock valuations mean little. Financial institutions, traders and investors have to liquidate positions to raise cash. Businesses can't access capital to meet short-term obligations and commerce comes to a screeching halt.

This is a time to pay down debt and curb spending. Get your own balance sheets in order and be prepared to short this market. I don't know when the big hurt will come, but I expect there will be a number of mini crashes before the big one comes. With each decline, the government will make a halfhearted attempt to restore confidence. Traders will realize that the Fed has also fired all of their bullets and a big drop will follow.

As bad as the situation is in the US, debt levels are even worse in Europe. Thirty years of reckless spending will not be resolved in one year. Like fools, our leaders believe this problem can be solved by spending more money.

The market is down a little today. It has been particularly strong during the recent rally and I don't want to jump the gun on short positions. When the SPY closes below 112, I will buy puts. When the SPY closes below 108, I will add aggressively. If the market continues to rally, I will sell out of the money put credit spreads to generate income, but these positions will be relatively small. As the market moves higher, I will raise the entry points for my put purchases.

The economic numbers this week should be "friendly". The FOMC statement could have a bearish impact since additional measures could be taken to unwind quantitative easing. This is the first Monday in months where the market has traded lower and that could be a bearish sign. Expect a choppy week as the market tests resistance at the high of the year.

.

.

Americans have mimicked the government and they have gone on a 30-year spending spree. We have taken out home equity loans and we refinance our mortgages at the lowest rate in 50 years after 9/11. This "stimulus" fueled the last economic boom and that final bullet has been fired. That is why low interest rates in 2008 - 2009 will not result in another big economic boom. That money has already been spent.

Federal, state, municipal and household debt is at an extreme level and this fish stinks from the head down. When a credit crisis strikes, stock valuations mean little. Financial institutions, traders and investors have to liquidate positions to raise cash. Businesses can't access capital to meet short-term obligations and commerce comes to a screeching halt.

This is a time to pay down debt and curb spending. Get your own balance sheets in order and be prepared to short this market. I don't know when the big hurt will come, but I expect there will be a number of mini crashes before the big one comes. With each decline, the government will make a halfhearted attempt to restore confidence. Traders will realize that the Fed has also fired all of their bullets and a big drop will follow.

As bad as the situation is in the US, debt levels are even worse in Europe. Thirty years of reckless spending will not be resolved in one year. Like fools, our leaders believe this problem can be solved by spending more money.

The market is down a little today. It has been particularly strong during the recent rally and I don't want to jump the gun on short positions. When the SPY closes below 112, I will buy puts. When the SPY closes below 108, I will add aggressively. If the market continues to rally, I will sell out of the money put credit spreads to generate income, but these positions will be relatively small. As the market moves higher, I will raise the entry points for my put purchases.

The economic numbers this week should be "friendly". The FOMC statement could have a bearish impact since additional measures could be taken to unwind quantitative easing. This is the first Monday in months where the market has traded lower and that could be a bearish sign. Expect a choppy week as the market tests resistance at the high of the year.Daily Bulletin Continues...