The Higher It Goes – The Better The Short!

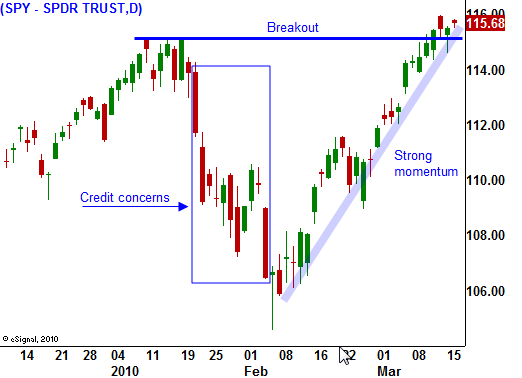

Today, the market continues to march higher after breaking out to new highs. The volume is light and momentum is driving it higher. Option expiration buy programs are likely to kick in and there might be a little short covering.

The economic news this week is fairly light and there is nothing to stand in the way of this rally. This afternoon the FOMC will release its statement and most economists believe that the comments will be unchanged. They will reference the exit strategy for quantitative easing and there is a slight chance for a negative reaction.

Democrats are pressing hard to pass health care reform. Most analysts feel that they have enough votes to push it through. From a fundamental perspective, I view this as a huge negative for the market on a longer-term basis. Our budget deficit is enormous and it can't shoulder another huge expense. All of this talk about cost savings is BS.

Healthcare is a finite resource. It takes years of training to become a doctor or nurse and hospitals can't be built overnight. Simple economics tells us that when supply remains constant and demand increases, prices will rise. When we add 50 million Americans to the system, prices will rise. Services will be greatly reduced for those who already have insurance. If you have a surgery or exam you have been putting off, get it done now.

The government can't even control Medicare and Medicaid, yet they will lower costs for the entire nation. Last year, Medicaid spending went up by 12% last year alone. VA hospitals demonstrate the government's ineptitude and our soldiers receive terrible healthcare.

The market is ignoring the debt issues that will haunt us for decades. Right now, great earnings, strong balance sheets, low interest rates, gradually improving economic statistics and momentum are carrying us higher.

My frustration is running high, but not from a trading standpoint. I hope this market skyrockets so that the best shorting opportunity of my lifetime presents itself. I am currently making money in this market and I am waiting patiently for that opportunity.

As an American, I can't stand to see our country gutted by politicians. In a few short years, all of the revenues we generate won't cover a handful of mandatory expenses (Social Security, Medicare/Medicaid and national debt interest payments). From that point on into perpetuity our national debt will continue to escalate. There are $1.4 trillion worth of discretionary expenses like defense, human services, transportation, Veterans Affairs, education, homeland security and many others that will drag us further into debt each year. Eventually, investors will stop buying our bonds. The credit risk will jump when it is obvious we will never pay off our debt. As the cost of capital increases, our interest expense on our bonds could account for more than a third of our annual budget.

If our national debt were financed at 5%, our current annual interest expense would be $650 billion. That is already 30% of this year’s total revenue. Our actual interest expense is much lower because we are financing our debt with short term bonds (4 year average maturity).

For those who still hope that we can claw our way out of this hole, our country has had a budget surplus five out of the last 40 years. Most of those years, we were only a few billion dollars to the plus side. At best (1999), we had a $225 billion surplus. That is chump change compared to what we are burning through and it was our best level in four decades.

The market could continue higher for a few months. Eventually, economic growth will stall and budget deficits will grow. A credit crisis will emerge in Europe and the number of countries seeking aid will quickly increase. The magnitude of the problem will become obvious and credit markets will freeze. At this juncture, we won’t be putting out small “Greece fires” (pun intended) and every country will fend for itself.

You will hear this same commentary until we breakdown and that could be months away. I don't know when the crash is coming, but it is not too far off. Be patient and wait for support to fail. Then start establishing short positions. Now that we have a new high, you can buy puts on a close below SPY 115. Add at SPY 112 and SPY 108. As the market moves higher, we will raise our entry point for put purchases.

Daily Bulletin Continues...