Ride The Momentum – Exit Longs and Buy Puts If SPY $115 Is Breached!

In the absence of any big news, the market continues to push higher. We have broken out to a new high for the year and option expiration buy programs are "goosing" the market higher.

Corporate earnings are solid, balance sheets are strong, interest rates are low and economic statistics show modest growth. Fear is low and the VIX has hit its lowest level since November 2007. Speculators and hedgers are not buying puts and that is why implied volatilities are dropping. Emerging markets are once again in favor and many believe that they will pull us out of this recession.

Unfortunately, those countries have very little wealth and they don't have an established middle-class to drive consumption. Europe, the US, and Japan are in a recession and collectively they represent the largest economies in the world (except China). Even in the best of times, when our economy was humming along, our government only managed a $225 billion budget surplus. That was the best it has been in the last 40 years. During 35 of the last 40 years we have run massive deficits. This year alone, we will run a $1.5 trillion deficit. We're spending money hand over fist and I do not believe I will see another budget surplus in my lifetime.

This is the first year when the money going into Social Security was less than the money coming out. Baby boomers are retiring and this trend will accelerate. Medicare and Medicaid expenses will also rise exponentially in coming years.

As if our national debt was not large enough already, we are waiting to hear if Democrats will force through a national healthcare program. We are told the program will pay for itself. The government can't even control Medicaid costs (up 12% last year) and we are supposed to believe that they can do a better job on a larger scale. Ask any veteran about quality healthcare and they will share their "government-run" experience.

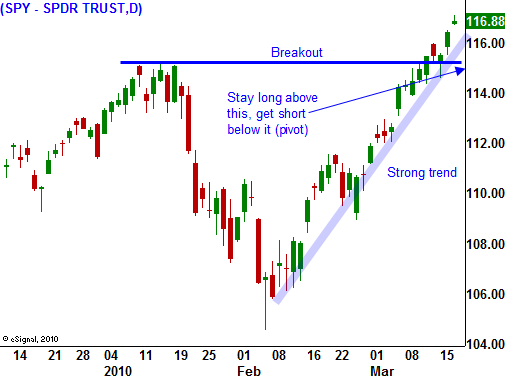

Right now, all of the positives are in focus. The market has turned a blind eye to the credit crisis that looms. Trade this rally, but be ready to pivot at a moment's notice. We have broken out to a new high and we can raise our entry point for put purchases. If the market closes below SPY 115, exit all long positions and buy puts. In today's chart you can see that I have identified that level as a pivot point.

This morning, PPI came in better than expected. It was helped by lower energy prices. This is good news, but it begs one question. Where is the demand for oil? This is the fabric to every economy and a global recovery would increase consumption.

Just before the Titanic hit the iceberg, everyone was having the time of their life. They had no idea of what was about to happen. I’m not trying to scare you; I just want you to know the truth. Enjoy the party, but stay close to the life boats. This ship set sail 40 years ago and like it or not, there is no getting off.

I have stopped selling out of the money put spreads and I have reduced my new positions. Implied volatilities are dropping and I am not being properly rewarded for the risk. I will generate nice income when these positions expire in a few days. Next month, I might have to buy calls in very small size if the market continues to grind higher. This is a premium buyers market. I will very cautiously ride this market higher knowing that the rug can be pulled out from under me at any time. All it will take is a poor bond auction in Portugal, Spain, Italy, Ireland or England. When that happens, I will quickly shift to put buying.

We have not seen big volume and short covering on this breakout. Asset Managers do not believe that they will miss the next big rally and they are not aggressively bidding up stocks. Don’t fight the trend, be patient.

Daily Bulletin Continues...