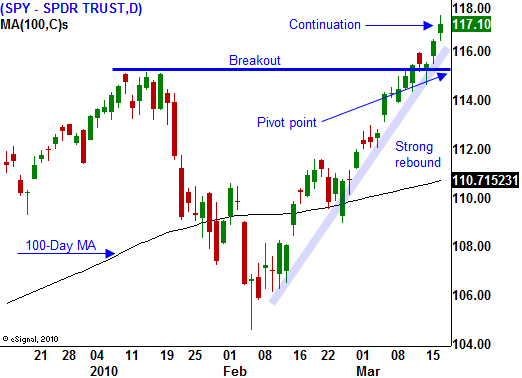

Don’t Short Until SPY 115 Is Breached!

The market marched higher this week and it broke out to a new high for the year. Option expiration buy programs have "goosed" the market and resistance is minimal.

Strong balance sheets, good earnings, low interest rates and gradually improving economic conditions have been the catalysts. On a valuation basis, stocks are attractive. Option implied volatilities have plummeted and the VIX has dropped to levels not seen since November 2007. Speculators and hedgers are not buying puts. This means the confidence level is high.

Now that the market has clearly broken out, we have a defined pivot point. As long as the SPY stays above 115, take bullish positions. Keep your size small. I have been selling out of the money put credit spreads to distance myself from the action. Now that option premiums have declined, call buying makes more sense. I am very skeptical of this light volume rally and I am only buying a handful of calls to generate income while I wait for a put buying opportunity.

If the SPY breaks below 115, take short positions. Speculators have been buying calls on this breakout and if we reverse, they will quickly be flushed out of their positions just as they were in January. The first stage of this move comes quickly and you have to have your orders placed in advance on a GTC basis.

This morning, FedEx said that domestic shipping volume increased 1% during the last quarter. If we are in an economic recovery, where's the volume?

Today, the CPI came in as expected and inflation is not a concern. Yesterday, the PPI fell due to lower energy prices. If we are in a global economic recovery, why is the demand for oil flat?

The economic news has been light this week and we will get more significant numbers next week. Durable goods orders, GDP and initial claims will be the highlights. It will take many consecutive weak economic numbers to roll this market over. Strong earnings and low interest rates are a tough combination to fight.

The credit crisis in Europe will be the catalyst for major decline. It will take more than Greece to raise fear and we will need to see dismal bond auctions in a few other countries. When this happens, the market will fall through major support levels and it will be critical to hold short positions as long as possible.

Before we get to that point, we are likely to see minor declines. The market is overbought and a weak economic release or two could spark profit-taking. These declines will be temporary in nature and it will be important to take profits when the momentum stalls.

So here is the game plan. Option premiums are cheap and you need to buy calls in small size. Ride the momentum and take profits along the way. When the SPY breaks 115, buy puts. If the news is relatively minor, look to take profits when the momentum stalls. If the European credit crisis is spreading and one or two other nations are unable to raise capital, hang in to your shorts and add to short positions on rallies.

I still think there is time before this storm hits. Major countries can still come to the rescue, but as the problems grow, we will reach a breaking point.

Daily Bulletin Continues...