The Market Will Not Like The Healthcare Outcome – Either Way!

Nervous trading has set in ahead of the healthcare vote. Option expiration is also adding to the volatility.

If the healthcare bill gets passed, budget deficits will grow quickly. that will raise credit concerns in the long run. Does anyone really believe that providing 50 million people with healthcare will save the country money?

If the bill does not get passed, our country will be caught in deadlock. Democrats will lose face and it will show that DC can't get anything done. Either way, I believe the market pulls back.

This is not the big decline we are looking for. It will be tradeable, but you have to take profits. The big decline will be related to credit issues in Europe, not US politics.

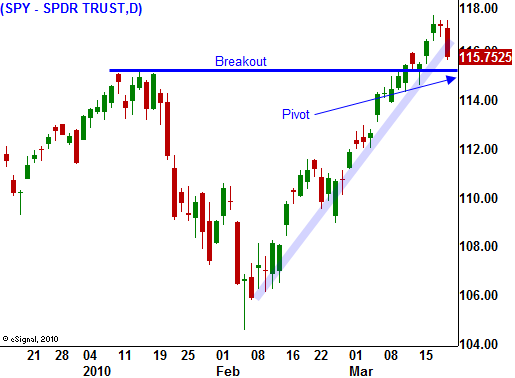

Get short if the SPY breaks below $115. Manage profits and know that this is not a sustained decline. It is just nervousness and profit taking from an overbought condition.

The bigger decline is still a few months or more away. We need to see a failed bond audction in Spain, Portugal, Italy, Ireland or England. Then the real selling will hit.

Strong earnings and low interest rates are a powerful force and it will take major news to topple this rally.

If you don't want to get short, at least get out of long positions.

Daily Bulletin Continues...