Investors Pull Money From Greek Banks – The Market Does Not Care!

Not much has changed in the last day. The market continues to grind higher and it is discounting the threat of any credit crisis.

The Unemployment Report came in lighter than expected, but that might have been a blessing in disguise. A positive number showed growth, but not enough to raise tightening concerns. The market was closed Friday and demand was pent-up over the three-day weekend.

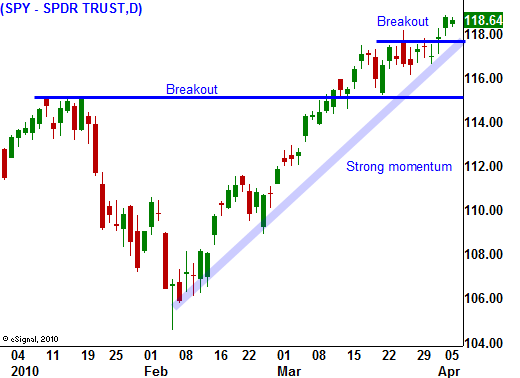

Prices were already set to move higher when the ISM services number was released yesterday. It came in much better than expected and it provided additional fuel for the rally. We staged a breakout to new highs and this morning, the market has been able to overcome early losses.

Greece continues to struggle with financing and investors are pulling money from its banks. Rumor has it that Greece wants to renegotiate the terms of its IMF aid feeling that terms are too constrictive. This problem is just starting to escalate. In the next few months the PIIGS will auction over €400 billion in treasuries. The demand could be weak across the board and the magnitude of the problem will be revealed. This probably won't happen overnight, but after the first few auctions, demand could wane.

With this new supply of bonds we could see upward pressure on interest rates. India raised rates two weeks ago and last night, Australia raised interest rates. Many speculate that China will raise rates soon to put the brakes on a runaway economy.

We are entering a quiet period. The market liked the major economic releases that hit the market recently and new economic releases are relatively insignificant. This afternoon, the FOMC minutes will be released. I am not expecting any surprises and traders are prepared to hear that the training wheels will be removed now that economic conditions are strengthening.

Earnings season approaches and in October and January we rallied ahead of the actual announcements. There is nothing to stand in the way of this market rally. The volume is light and we continue to drift higher.

I feel as though most people are on a fantastic canoe trip. The current is with them, the sun is in their face and the scenery is beautiful. Unfortunately, they are approaching the Niagara Falls and they are oblivious to it.

On the surface everything looks great. Corporations are strong and they have great balance sheets. They are trading at relatively low valuations and M&A activity is picking up. However, as we saw last year, when a financial crisis strikes, you can throw valuations out the window. Commerce locks up and assets are liquidated at any price to raise cash. Stocks were not over-valued in 2008; they sold off because of the credit crisis.

Financial institutions are no longer the issue. They have plenty of toxic crap on their books, but over many years, they are in a position to gradually take their write downs. Leverage has also been reduced greatly and new equity has strengthened balance sheets. The risk has shifted from financial firms to the government.

Cyclical stocks have been very strong and they have good momentum. You can day trade them or buy calls on them. Don't over stay your welcome and take profits along the way. If the SPY closes below 118, the recent breakout will have failed and you can buy puts. We are likely to see a short, swift decline if this happens. Bullish speculators need to be flushed out and they are overconfident. Keep your positions small. A close below SPY 115 would warrant taking a larger put position, but we are not likely to see that for at least a few weeks.

As I have stated before, I am not trading this rally. I might take a small put position on a close below SPY 118. I am waiting for a close below $115. Then I will get more aggressive.

Daily Bulletin Continues...