The Fed Might Not Plan To Raise Rates, But The Market May Push Yields Up – Watch the 10-Year Auction

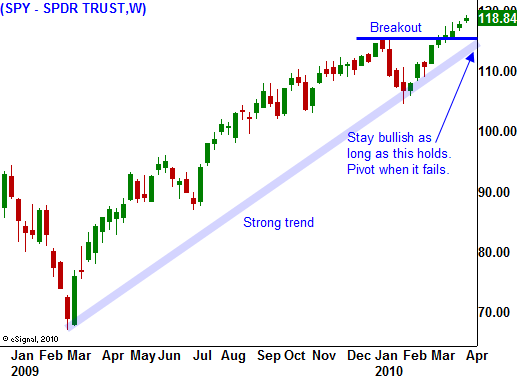

The market is taking a breather today after a nice run-up and a breakout to new highs. Economic statistics point to a recovery and the path of least resistance points upward.

The Unemployment Report came in lighter than expected, but it showed substantial job growth. This had been widely anticipated by analysts. The number was "not too hot and not too cold". This means that the Fed won't feel immediate pressure to tighten. In yesterday's FOMC minutes, the Fed did not feel compelled to raise rates.

From my perspective, private sector jobs are the missing element. The government has spent trillions of dollars trying to revive this economy and it has exhausted its resources. Our national debt is escalating out of control and politicians on both sides of the aisle realize that future stimulus proposals will hit heavy resistance. This means corporations need to drive the recovery from this point on.

Companies are flush with cash, but they are reluctant to hire. Productivity has increased dramatically and they don't want to add to their overhead until they see concrete evidence that demand has returned.

Corporate profits are growing, balance sheets are strong, merger and acquisition activity is picking up and interest rates remain low. Stock valuations are reasonable, if not cheap. As interest rates remain low, equities represent an attractive investment alternative. Normally, you would expect the market to rally under these conditions. It has moved higher, but it has not jumped.

Investors realize that major credit problems could quickly return. Risk has shifted from financial institutions to the government. Federal, state, municipal and personal debt levels are extremely high. Without much "gas in the tank", the economy will struggle to recover. Asset managers know this and they are not chasing stocks.

The thought of a US financial collapse was inconceivable prior to last year. How could the wealthiest nation, the reserve currency of the world be called into question? Just one year later, this threat once again seems remote to most people. I took notice and I will not ignore that warning sign.

Most analysts won’t even speak of a financial collapse. It is un-American and they don’t want to alienate their potential investors. They would rather go with the flow and to act surprised when it happens, even though they know the possibility exists.

Greece is a microcosm of what is likely to happen. It has gone through a great deal of turmoil to secure aid. From a financial perspective, we are not talking about a lot of money. Imagine what will happen when the PIIGS come to market with €400 billion worth of bonds in the next few months. That debt needs to be refinanced and the demand will be weak.

Greece is squirming like a worm on the end of a hook. Rumor has it that it wants to secure alternative financing. It feels the IMF terms are too restrictive and it can't come to grips with the tough actions that are required for it to balance its budget. Foreign investors are pulling money out of Greek banks and that could start a run. Credit concerns spread quickly as we learned last year.

This credit problem will continue to grow and our economic recovery will slow down once inventories are replenished. Interest rates are heading higher and that will provide a stiff head wind. With each passing month, risk will increase.

For now, the market has strong momentum and that should continue ahead of earnings season. Once the actual results hit the market, we could see a pullback. That pattern appeared in October and it repeated in January. Stocks are already priced for good news.

The next big move is down. If you are playing the rally, limit the number of positions and keep your size small so that you can get out quickly. If the market closes below SPY 118, there is a chance that we will see a short, swift decline as bullish speculators bail out. That is a tradable move and you can buy puts. This will be nothing more than technical selling and the market will be able to rebound.

The real trade we are looking for will result from weak economic data (unemployment starts to grow) or poor demand in European bond auctions. Those fundamentals will push the SPY below key support at $115 and that will be a bearish move that you can get aggressive with. Until then, keep your size small and be patient.

This afternoon, we will be auctioning ten-year bonds. That news will hit the market around noon. I am not expecting a particularly good auction and this could weigh on the market. The Fed might not want to raise rates, but if the market believes it needs to, it will start pricing that in and rates will rise. Tomorrow, there will be another bond auction and another bullet to dodge. We could see a decline this afternoon.

Daily Bulletin Continues...