Earnings Season Starts Monday. Will Traders Sell The News Like They did In Oct and Jan?

Yesterday, the market finally looked like it might pull back. Initial jobless claims were weak and credit concerns in Europe pressured the market in early trading. As the day unfolded, buyers stepped in and we rallied into the close.

The upward momentum is very strong ahead of earnings next week. In October and January, we saw a market rally before the first announcement and a decline once earnings season started. I believe this pattern will repeat itself. Great results are already priced into stocks.

Alcoa will post its results next Monday. Other big releases next week include CSX, Intel, J.P. Morgan Chase, YUM Brands, Google, Bank of America and GE.

The worries in Greece have subsided again and European stocks rallied overnight. With each passing month, Greece will move closer to the breaking point. Next week, Portugal will auction bonds and weak demand will reveal another sovereign debt concern. In the next few months, all of the PIIGS will hold major bond auctions and the problem will start to escalate. This will weigh on the market, but we are many months from reaching a critical point.

Great earnings, solid balance sheets and low interest rates will keep a bid to this market. The Fed does not want to raise rates. They fear that the economic recovery could stall. Government stimulus has almost reached its end and the private sector is not hiring. Once the inventories have been replenished, economic activity could slow down. Last quarter, FedEx reported a 1% increase in domestic shipping volume year-over-year. If we are in a recovery, where is the shipping volume?

The Fed is searching for signs of activity and they fear that this rebound lacks substance.

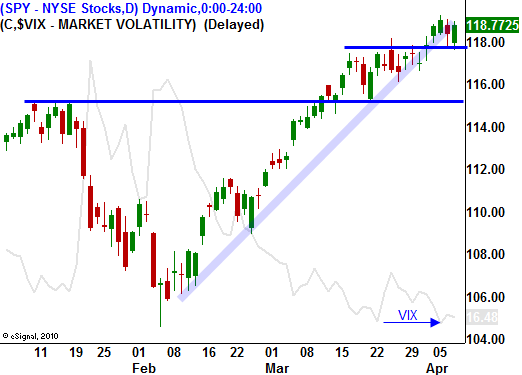

I feel we are setting up for a swift pullback. The sentiment is too bullish and it is too easy to be long. Every dip is a buying opportunity and “Joe retail trader” steps in to buy it. When the market gets predictable, expect the unexpected. When SPY 118 is breached, bullish speculators will be flushed out of their positions.

Stocks will retreat once earnings are released. I expect the results to be good, but that is priced in. The surprises (if any) favor the downside.

Buy puts if the SPY closes below 118. If you have long positions, place stop orders and be prepared to get out in the next few days.

Daily Bulletin Continues...