Earnings Will Be Good. Will They Be Good Enough?

This morning, the market is trying to push higher. Typically, Monday's have been very strong and today's action is lackluster.

Over the weekend, the EU put together a €40 billion aid package for Greece. Stronger EU members are able to borrow at lower rates and pass that lower cost of capital along to its ailing neighbor. This aid will come with conditions and EU members have been reluctant to backstop the problem.

Greece has not accepted the bailout yet and it still plans to test the waters Tuesday and Wednesday with its bond auctions. If the demand is decent, it will try to go it alone. I believe the bond auctions will fail and Greece will be forced to take the aid. The real question will come later in the week when Portugal holds its bond auction. What will happen when many weak EU members need financial aid?

The PIIGS will auction €400 billion of debt in the next few months. The magnitude of the credit crisis will be revealed and aid will dry up. EU members are already balking at aid four little ole Greece, and they won't step up to the plate for Spain. The problem is too big to keep backstopping everyone’s debt. Overspending is still the problem and liberal social programs need drastic reform.

Today, Alcoa will release earnings after the close. In October and January, the market rallied ahead of earnings announcements and stocks declined after releasing the news. Crazy takeover rumors are heating up and that is often a sign that the market is reaching a top. Often, the market has run out of gas and rumors provide the in a final push higher. Stocks are priced for great earnings and there is room for disappointment.

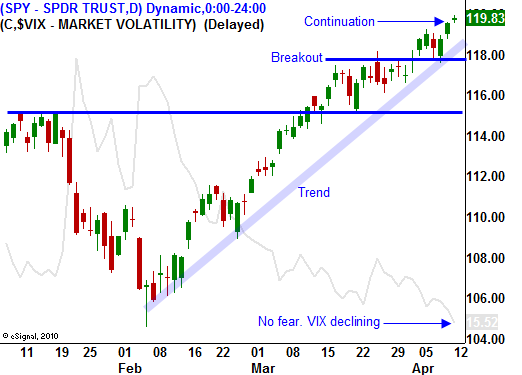

I would not start shorting this market on the notion that we will see a swift decline. Without question, bullish speculators are vulnerable and once we get the first move down, they will rush for the exits. I would suggest taking profits on long positions. If the SPY closes below 118, buy puts. The next support level is SPY 115. If the market finds support at that level, take profits on the short positions. On the other hand, if that level fails easily, add to the position and buy more puts. That is a major support level and if it is breached, the selling pressure will accelerate.

The economic news is light this week and I am not expecting any surprises. Earnings will drive the action and most of the companies will release excellent results. Will they be good enough?

This is a time to reduce your trading activity. We need to evaluate the earnings and the guidance. Most importantly, we need to monitor the market’s reaction.

Daily Bulletin Continues...