Buy the Rumor – Sell the News. Intel is On Deck. Watch the European Bond Auctions!

Yesterday, the market staged a half-hearted rally after Greece secured €40 billion in aid from the EU. This credit crisis has been weighing on the market and it could have sparked a bigger rally than it did. "Merger Mondays" have been very bullish and the market also had that working in its favor.

Overnight, Greece held a bond auction prior to accepting the aid. It wanted to test the market and gauge demand for its debt. The offering was oversubscribed, but yields jumped. The signal was mixed. The market will buy Greek bonds if the yield is sufficiently high. Greece can secure loans, but the cost of capital is very high. It also does not know if the strong support was influenced by the EU’s bailout.

This problem is far from over. Greece does not want to take the aid because terms are too restrictive. They still need to reform their social/retirement programs or the problem will continue to haunt them. Greece sold €1.5 billion in short-term treasuries last night. They still need to secure €8.5 billion before the end of the month. Unfortunately, PIMCO (the world's largest bond fund) will not be participating. They don't feel Greece has done enough to solve their long-term problems.

This is one small country in Europe and it is a microcosm of what's to come. Portugal will be issuing bonds later this week and I am expecting the auction to go poorly. They will be the second country to line up for aid. They had a €1 billion one-year T-bill auction fail miserably in February. In the next few months, the PIIGS will auction €400 billion in debt. The deficit problems are extraordinary and the demand will be low. Imagine the EU's dilemma as countries start lining up for aid one by one.

In the US, small business owners have little confidence in the economy. The national Federation of Independent Business said its monthly index small business optimism fell 1.2 points in March to 86.8. Poor sales and uncertainty are overpowering improving economic news. Small businesses account for 50% of all jobs and they have their finger on the pulse of the economy. If they are not optimistic, the recovery is in question.

Yesterday, earnings season kicked off after the close. Alcoa has been one of the Dow's worst performers and it did little to impress "the street". In October and January, the market rallied ahead of earnings and it sold off during the actual releases. Stocks are priced for great news and I believe that “buy the rumor, sell the news” pattern will continue.

Today, stocks are weaker. The news is not that dire, the market is simply overbought. Bullish speculators have rushed in and they need to be flushed out. Option expiration week is a perfect time to do that.

Decliners outnumber advancers by 2:1 and I believe we will see a decline today. Intel will release earnings after the close. The stock is at its 52-week high and there is room for disappointment.

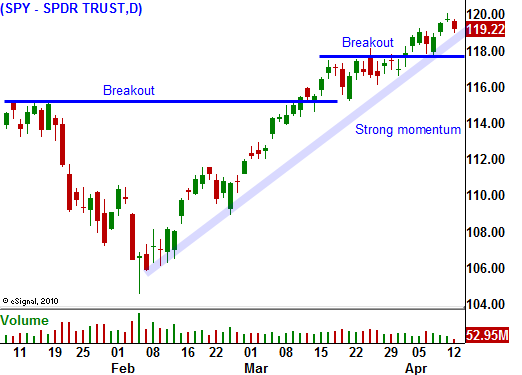

I have been waiting for a pullback, but I do not want to jump the gun. Buy puts on a close below SPY 118. The next support is SPY 115. If the market easily falls to that level and it breaks that support, add to your short positions. This would be a major breakdown and the selling pressure will accelerate. If the market finds support at that level and it starts to bounce, take profits on your initial put positions.

The trend has been very strong and the momentum is powerful. It will take many bearish events to counteract great earnings, strong balance sheets and low interest rates. Concrete evidence of a credit crisis in Europe would be big enough to topple this market. Otherwise, we will need to see unemployment start to rise. Both of these scenarios will not happen instantly. Conditions will deteriorate over a matter of months and I don't feel we are close to that breaking point just yet.

This first decline is likely to be profit-taking and a technical selloff from overbought conditions. I am not expecting it to be a major decline.

Be patient and know that a big drop is a few months away.

Daily Bulletin Continues...