Market Rallies On – Great Earnings, Strong Econ Data, Good Euro Bond Auction and Low Interest Rates!

This morning, the market is moving higher on an excellent round of news. The S&P 500 has broken out above 1200 and the Dow is above 11,000.

Intel beat estimates and gave strong guidance. This morning, J.P. Morgan Chase blew away estimates and referenced a strong economic recovery. CSX said that shipping volumes are improving. Each of these stocks moved through resistance, but they have pulled back slightly from their highs of the day.

This morning, the CPI rose .1% and it was benign. Inflation is not an issue and it will not put upward pressure on interest rates. Retail sales jumped 1.6%, much higher than analysts had expected.

These items did not surprise me. The market is expecting good results and that news is priced in. The surprise came from Europe. Overnight, Portugal successfully auctioned €2 billion in 10-year bonds. I did not expect this auction to go well, especially after the failed auction in February.

Stocks are adding to gains and advancers outnumber decliners 2:1. The market is likely to drift higher today.

The first two weeks of earnings tend to be very strong. Some of the best banks and technology stocks report early in the season. In October, the market jumped after Intel and IBM reported. That move signaled the top and stocks pulled back as earnings season progressed.

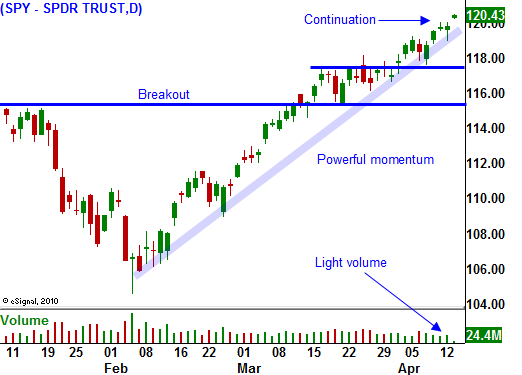

It is foolish to try and short this market. The momentum is strong and stocks want to move higher. We are overdue for a pullback, but we could move higher before it happens. Bullish speculators need to get flushed out of the market. The market's strength leads me to believe that any decline will be short-lived and it will be viewed as a buying opportunity.

I am seeing many stocks fly higher on rumors. PALM, JEC and HOG are recent examples. The fundamentals are weak and rumors like this are often the last push in an over-extended market.

The strength in Portugal's bond auction really threw me for a loop. The credit crisis could be a few months farther out than I had originally expected. I won't chase stocks higher; I will patiently wait for pullbacks. Traders typically "buy the rumor and sell the news". Look for stocks that have broken out to new highs and that pullback to that breakout after releasing excellent earnings. Those will be good candidates and they will move higher as long as the market holds its ground. If that breakout level fails, get out of the stock.

I am not abandoning my bearish game plan. I will limit the number of bullish positions and I will keep my size small. I need to generate a little income while I wait for support to be broken. Buy puts on a close below SPY 118. The first decline is likely to be short and swift. It will flush out bullish speculators and the market will rebound quickly.

It will take months to sour this market and months of bad data will be discounted until it finally confirms a slow down. Bulls are savoring great earnings, strong balance sheets and low interest rates.

This morning, the Fed Chairman reiterated that interest rates will stay low for an extended period of time. The market has all the news and momentum it needs to move higher today.

Daily Bulletin Continues...