Enjoy This Tax Day! Taxes Are Going Up. Someone Has To Pay For This Party.

The market continues to grind higher. The news has been "friendly" and prices have moved upward ahead of earnings releases.

Early in the week, Greece held a bond auction in hopes of avoiding the bailout package extended by the EU and IMF. The bond offering was successful, but interest rates in Greece jumped higher. Large Asset Managers like PIMCO feel that the risk is high and Greece has not done enough to reduce deficits. Surprisingly, Portugal held a successful €2 billion 10-year auction. The PIIGS will issue €400 billion in debt in the next few months and this large supply of bonds could raise credit concerns if the demand is low.

Earnings releases have been positive. Intel blew estimates away and it sees a rebound in capital expenditures. CSX said that there are signs of increased shipping traffic. That was confirmed by UPS when they pre-announced earnings this morning. J.P. Morgan Chase said that write-downs are decreasing and they believe an economic recovery is underway.

Most of the economic news has been positive. The CPI was benign and it increased .1%. Empire Manufacturing and the Philly Fed both came in better than expected and the Beige Book also showed improving economic conditions across the country. This morning, initial jobless claims rose 480,000. That was much higher than expected and it follows a dismal number from last week.

In a small business survey, entrepreneurs said that they are still not hiring. They do not believe that an economic recovery is under way. Small businesses employ 50% of all workers and they have their finger on the pulse.

This week, the Fed Chairman stated that interest rates will stay low for an "extended period of time". He still believes the economic recovery is fragile.

On a global basis, rates are on the rise. India, Australia and Singapore have increased rates during the last week. China's GDP grew at over 11% and they will raise rates. They have already raised bank reserve requirements 3 times this year. Investment in China has reached speculative levels and when current commercial real estate projects are completed, they will have 30 billion square feet of office space. That means every man; woman and child can have a 5 x 5 cubicle.

Foreclosure rates in the United States continue to rise. People are spending money on discretionary items and they are not paying their mortgages. Credit card companies have these records and they confirm that this money is being spent. Homeowners are under water and the do not fear being kicked out of their homes. People are living rent free and that has artificially elevated retail sales.

Taxes on a federal, state and local level will increase. While the government can continue to print money, state and local governments cannot. They are quickly cutting expenses and laying-off workers.

Unemployment benefits and severance packages are running out. If the employment situation does not improve quickly, consumption will decline.

It is difficult to stay bearish when the market continues to surge higher. However, the headwinds will blow hard in coming months. Corporations can see the storm clouds and they are reluctant to hire employees. They don't want to add to overhead. In the last year, productivity has increased and companies are running lean and mean.

Higher interest rates, tax hikes, low employment and renewed credit concerns will haunt the market in the next six months. Almost everyone has dismissed the chance for a double dip recession and I am a minority. Decades of overspending will not be solved by spending more money.

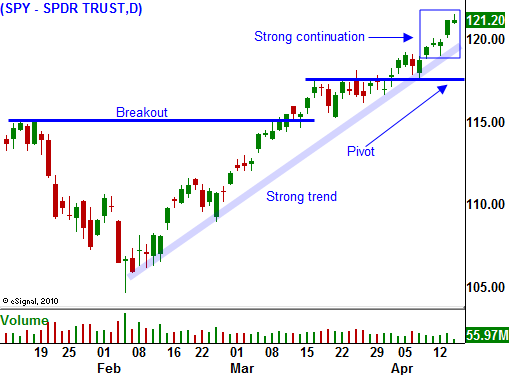

Trade the rally, but don't get aggressive. Limit the number of positions and keep your size small. Watch the bond auctions in Europe. As the PIIGS sell bonds, watch for higher yields. That will signal a decline in demand. Also watch the employment figures. In the next two months, census hiring and government stimulus will wind down. By mid-summer, job growth should start to slow. Most stocks are priced for a full economic recovery and when we stumble, there will be many shorting opportunities. As long as the SPY is above $118, trade the rally. If that level fails, pivot. In October, the market rallied after the first week of releases and then it reversed. We might see the same pattern this quarter.

Daily Bulletin Continues...