Buy the Rumor – Sell the News. Stocks Decline After Beating Estimates.

This morning, the market is pulling back after a great round of earnings news. The weakness started last night when Google posted results. It handily beat estimates and the stock dropped $25.

Bank Of America, Intuitive Surgical, AMD and General Electric all beat estimates. All four stocks are trading lower this morning. Similar to the pattern we saw in October and January, stocks are selling off after releasing results.

This decline is tradable, but I don't believe the move will be sustained. In November and February, the market rebounded towards the end of earnings season. Stocks are priced for great results and traders "bought the rumor and they are selling the news". Earnings will be excellent and companies are running lean. Balance sheets are strong and corporations are flush with cash. Last week, the Fed Chairman said that interest rates will remain low for an "extended period of time". These factors will keep the market moving higher in the short term.

Longer-term issues will eventually weigh on the market. By late summer, employment should stall and job losses will be an issue. The credit crisis in Europe will worsen and two or three countries could be seeking financial aid. Taxes in the US will rise and that will hurt discretionary spending. Unemployment benefits and severance packages will run out and that will also reduce consumption. For now, the market is likely to discount the likelihood of these events.

The selling pressure was strong this morning, but it accelerated when the SEC filed fraud charges against Goldman Sachs. There is evidence that they knew of mortgage problems when they issued securities without full disclosure. The stock dropped like a rock and is down $20.

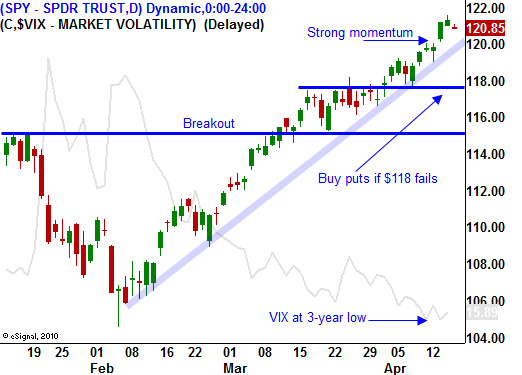

I am maintaining my game plan. If the SPY closes below $118, I will buy puts. When that happens, the market will test major support at SPY $115. If that level holds, take profits on your put positions. If the SPY breaks below $115, buy more puts. That is a major support level and the selling pressure will accelerate if it fails him and.

Next week will be filled with earnings announcements. By Tuesday we should know if traders are "selling the news". Be patient, we are getting closer to good bearish trades.

Daily Bulletin Continues...