Expect A Sharp/Short Decline. This Is Not The “Big One”!

Let me start off this week's comments with some straight-forward talk. I am long-term bearish, but I do not believe this decline is "the big one". The upward momentum has been very strong and it will take major developments to topple this market. This decline is likely to find support and it will set up a short-term buying opportunity.

The market decline resulted from an overbought condition. Bullish speculators needed to be flushed out. They have aggressively bought calls into earnings season and they have pushed stocks higher. Now that the results are being released, traders are "selling the news" and speculators are bailing out of positions.

The SEC's suit against Goldman Sachs caught the market off guard. When billions are lost and CEOs walk away from the wreckage rich, heads will roll. The government will go after big banks and this will be a political victory. If regulators weren't asleep at the wheel in the first place, this never would have happened. This news will temporarily pressure financial stocks, but it will not affect the overall market.

Earnings will continue to beat expectations. Last Friday, Google, Intuitive Surgical, Bank of America and General Electric all beat estimates and all of them sold off before the market cracked. This same “sell the news” pattern happened in October and January. Once the initial wave of selling past, buyers stepped in and the market rallied in November and February. We are likely to see moderate selling pressure this week, but I believe the market will hold up.

The key elements to a sustained decline will not surface for a few months. The credit crisis in Europe will start with failed bond auctions. Keep a close eye on yields as the PIIGS come to market with lots of debt in the next few months. Once our government's stimulus (and census) runs its course, unemployment will start to creep higher. State and local governments will terminate employees to balance budgets and they are running out of money. Higher interest rates in Asia will put upward pressure on our interest rates and in the next few months, the Fed will be forced into action. The market might start pricing that in and it will be important to watch our bond auctions every other week. If yields creep higher, the Fed will change its rhetoric from "extended period of time" to "unforeseen future". This will signal that rates will move higher and the headwinds will start to blow.

Consumption will decline as unemployment benefits and severance packages run out. The first signs will be reflected in lower retail sales and I expect to see this by the end of summer.

Taxes across the board (federal, state and local) will increase, but they won't be implemented immediately. The market is forward-looking and it will start pricing this in as the news is released. Massive deficits must be addressed or our bond ratings will decline. Higher taxes will also take a bite out of consumption.

I am anxious to take short positions, but I will not be fooled by this decline. The upward momentum is much stronger than I had originally expected and great earnings, strong balance sheets and low interest rates are a major force to deal with. As I mentioned earlier, we need actual evidence to turn this market. A slowing economy and a sovereign failure would certainly do it.

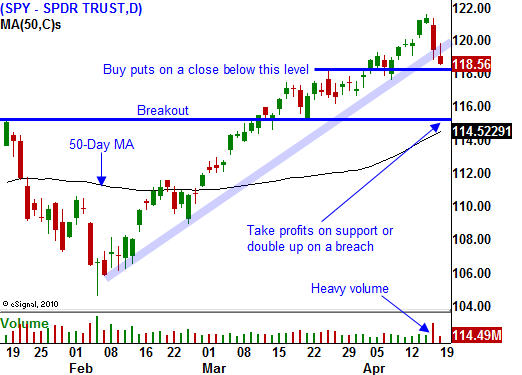

The market has stabilized after a nasty decline last Friday. If we close below SPY 118, I will buy puts. I will be quick to take profits and I feel that SPY 115 will hold. If it does, I will sell out of the money put credit spreads on strong stocks that have already released good earnings. If you share my bearish bias, temper your excitement and know that we are still months away from a sustained decline.

Daily Bulletin Continues...