Jobs, Jobs, Jobs! Growth Is Expected and There Is Room For Disappointment This Week.

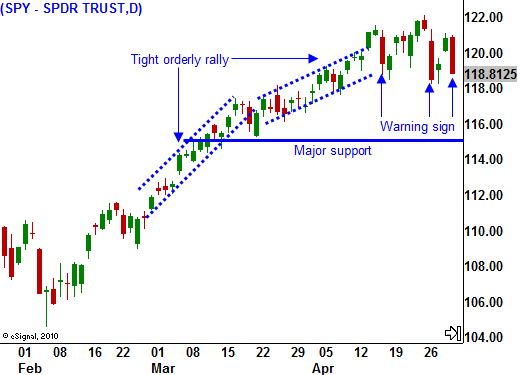

Last week, the market started to show signs of stress. In today's chart you can see that there have been three big declines off of relative highs. This indicates selling pressure and it represents a warning sign.

Greece has been in the spotlight and over the weekend the EU/IMF passed a $146 billion aid package. That comes to roughly $13,000 per citizen. Major austerity measures will be imposed in Greece and protests have become violent. The bigger development last week involved two other PIIGS members. The credit crisis spread to Portugal and Spain. Both countries had their debt rating downgraded.

Spain accounts for 12% of Europe's GDP and they are five times more significant than Greece. Last week, they reported that the unemployment rate surpassed 20%. They are still losing 290,000 jobs per month. Over a period of months, this situation will worsen. Many European countries have extreme debt levels and they will be holding bond auctions in the next few months. If the demand is light, interest rates will spike and credit risk will get priced in.

On the other end of the spectrum, China raised its reserve requirements over the weekend. This is the fourth time they have done so this year and they are trying to slow down a runaway economy. India, Australia and Singapore have raised interest rates. China could be very close to doing the same.

There have also been domestic issues that the market has had to digest. Goldman Sachs was grilled in a Senate hearing last week and criminal charges could be filed. Financial stocks took a beating on the news. Financial reform will happen and the battle lines are being drawn by both parties. A massive oil spill in the Gulf of Mexico could cost $14 billion to clean up. If the oil reaches land, it could have a devastating economic effect in the South. A failed car bombing in New York could have raised terrorism fears. Fortunately, the explosive device failed to detonate. All of these events have been discounted by the market this morning.

Economic releases will dominate the news this week. Today, ISM manufacturing came in at 60.4. That is a very robust number and it is close to consensus estimates. ISM services will be released later in the week and it will also be very important. Over 80% of our economic activity comes from the service sector.

The key to an economic recovery is employment. Wednesday the ADP employment index will be released. It measures job growth in the private sector. Analysts are expecting 30,000 new jobs. In March, ADP showed a loss of 23,000 jobs in the private sector and that contradicted the government's release. Perhaps we will see who was right when the numbers are posted this week.

Initial jobless claims have been increasing and that is not a good sign. This number really keeps its finger on the pulse of the economy and the four-week moving average is rising. That means there is room for disappointment in Friday's Unemployment Report. Consensus estimates are for 187,000 new jobs. If that materializes, the market should rally. It would come on the heels of 160,000 new jobs last month. Private sector jobs will be critical. Corporations need to start hiring as government stimulus winds down.

This morning, the market is rebounding. The news from Greece comes as a relief and this aid package should calm nerves. Beginning of the month fund buying is also supporting the market.

There are plenty of negatives that traders could latch on to, but the upward momentum is too strong to fight. The market is likely to move higher today. Technical resistance is building, but it will take a series of bearish news events to topple it. I don't believe we will see that this week. Even if the Unemployment Report comes in "light", the market will discount it as one bad number. Some traders will even see that as a positive since a bad number would support low interest rates.

I expect to see choppy trading between SPY 115 and SPY 121 for the next 3 weeks. Cyclical stocks look strong and there are some nice put writing opportunities. Restaurant stocks look heavy and there are some nice call credit spreading opportunities. Keep you size relatively small in this directionless market that has become more volatile.

Daily Bulletin Continues...