Goldman Sachs Weighs On Financial Sector. Big Economic Releases Next Week.

Yesterday, the market rebounded sharply and much of the losses from earlier in the week were erased. Strong earnings and likely aid for Greece fueled the rally.

Initial jobless claims came in at 448,000 yesterday morning. During the last four weeks, this number has been disappointing and the four-week moving average is moving higher. Next week, the ADP employment index (Wednesday), initial claims and the Unemployment Report (Friday) will be scrutinized. Analysts have been calling for job growth and they want confirmation that last month's number (160,000 new jobs) was not a fluke.

The government is still hiring census workers and that will "pad" the number. Traders will be looking for private sector job growth. Last month, ADP showed a loss of 23,000 jobs in the private sector and that contradicted the government's report. Next week, we will get to see who was right. Corporations have been slow to add workers and a sustained economic recovery can't take root until this changes.

This morning, Q1 GDP came in at 3.2%. That is down from 5.6% in Q4, but it was largely in line with expectations. Chicago PMI was much stronger than expected and it showed strong economic activity in the Midwest.

ISM manufacturing will be released Monday and that will be an important number. Manufacturing has been relatively strong as inventories are being replenished. Wednesday, ISM services will be released. The service sector accounts for 80% of our economic activity and it has also been strong. These two numbers have been bullish for the market in recent months.

The biggest development this week briefly shook the market. Interest rates in Portugal and Spain increased as debt ratings were lowered. This week, Spain announced that its unemployment rate rose above 20%. Workers are still losing their jobs at a high rate and unemployment benefits are running out. The credit crisis is starting to spread.

Greek interest rates spike to 19%, but the country secured aid from the EU and IMF. The immediate problem has been resolved, but major austerity programs need to be instituted. The country is plagued with civil unrest and cutbacks will be hard fought. Greek Air Force pilots called in sick to protest and labor unions have been striking. There is not an easy solution to the problem and it will escalate.

The market has been able to shrug off all negative news. Every dip has been viewed as a buying opportunity. In October and January, stocks declined after earnings were released. That pattern has not repeated itself and more than half of the stocks have rallied after posting results. The market has been able to tread water, but there might be a few red flags.

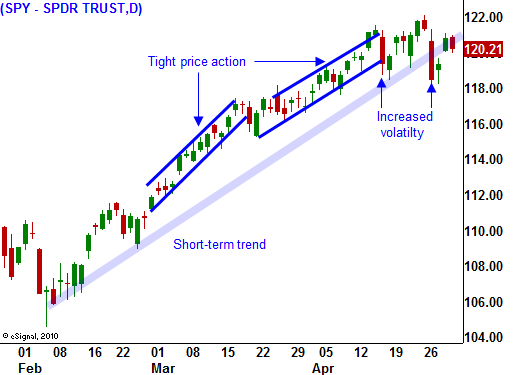

In today's chart you can see the tight, steady patterns that were present when the market climbed higher. In the last two weeks, volatility has started to creep back in. Random price movement near a relative high indicates resistance. We have seen two big down days on heavy volume that occurred near the highs. This is a warning sign.

Today, the market is giving back some of yesterday's gains. Goldman Sachs is weighing on the entire financial sector and it’s possible that criminal charges will be filed. The company has been downgraded and they have become a scapegoat for the financial crisis. Financial reform has hit a snag, but eventually it will pass. Financial institutions will be heavily taxed and their activities will be restricted. I believe this sector has topped out and if interest rates tick higher, profit margins will get squeezed.

The market is due for a swift pullback. I do not believe we are on the brink of a major decline - yet. Economic statistics need to deteriorate over a period of months and PIIGS bond auctions need to go poorly in May and June. When these two forces align, we have the makings for a sustained decline.

Half of the S&P 500 companies have reported and the surprise element from earnings will settle down next week. Economic releases will be the focal point and I believe there is room for disappointment. Greece will secure funding over the weekend and we are likely to see a rally Monday. Beginning of the month fund buying will also support prices. After that, I believe we have a chance for a pullback.

The upward momentum is strong and I would not buy puts until there is concrete evidence that the highs are in. If the market can take out the lows from Tuesday (SPY 118.50), buy puts and look to take quick profits. The market should be able to find support around SPY 115. If that level fails, you can get more aggressive with your shorts.

Daily Bulletin Continues...