Watch For Early Morning Rallies and Late Day Selling – The Sharks Are Circling!

A week ago, the market was celebrating a "shock and awe" move by the EU. To stem a freefall in the Eurodollar, they drafted a $1 trillion emergency bailout fund for ailing EU members. The message was clear, the EU was unified and they were taking immediate action to get ahead of the problem.

From the beginning, the EU has been noncommittal. They did not know if they would extend financial support to Greece. Months of deliberation left investors uneasy, particularly when the problem was so small (Greece only accounts for 2% of Europe's GDP). Members had barely approved the Greek bailout when interest rates in Spain and Portugal started to climb. The market was already sizing up its next victims.

The bold move last week sparked a 500 point reflex rally in the Dow. Bulls rushed in to "buy the dip" and the rally continued for two days. By Wednesday, the rally stalled and sellers unloaded stocks.

Throughout the entire week, the Eurodollar was crushed even when equity markets were rallying. Traders did not (and do not) believe that the EU will be able to survive. Debt levels are extremely high and many other larger nations are perilously close to default. Spain, Portugal, Ireland and Italy had to contribute to Greece's bailout even though they are close to needing aid themselves. The credit crisis will grow and stronger members (like Germany) will not jeopardize their own economies to save the likes of Spain.

Voters are already voicing their opinion and Prime Minister Merkel's popularity is dropping in Germany’s polls. This is only after agreeing to bailout one small country. Imagine the reaction when Spain (12% of Europe's GDP) steps up to the plate. Over the last 200 years, Spain has defaulted 13 times. This is nothing new for them and fiscal responsibility is not one of their strengths.

France is also considered one of the stronger EU members. It has not had a budget surplus in 39 years. Massive debt levels are found throughout Europe and the $1 trillion "slush fund" will be impossible to capitalize. Most nations are struggling with current bond auctions and the bid to cover is decreasing. This decline in demand is causing interest rates to move higher in Europe. Credit spreads are also starting to widen out and this reflects a drop in liquidity.

The warning signs for a full-blown credit crisis are present. As the problem grows, each nation will be forced to fend for itself. Banks and investors around the globe have tremendous risk exposure in Europe's sovereign debt. Defaults will send a shockwave around the globe and the banking system will freeze as it did a year ago.

Over the weekend, there weren't any new "silver bullets" fired. That's because there aren't any left in the gun. When the market failed to respect the $1 trillion bailout fund, it told me that we are quickly headed down a dark path. Nothing the EU says or does will change the attitude of investors. Large institutions will reduce risk and they will sell European assets.

The market will try to keep shorts honest and we will see a few short covering rallies in the early stages of this decline. For the next month or two, take bearish positions during rallies and take profits on weakness. Great earnings, strong balance sheets and low interest rates will keep hope alive and this market will be hard to turn.

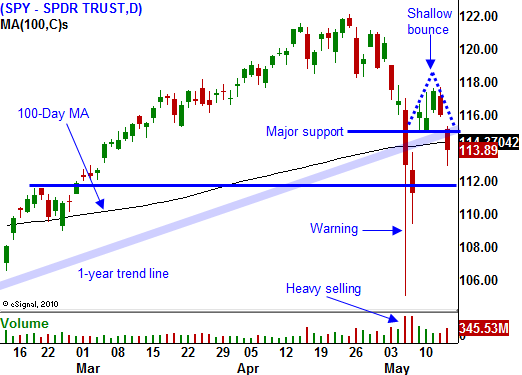

By the end of the summer, I believe a series of lower highs and lower lows will reveal a new trend. That is when we can expect a sustained decline and you will be able to stick with bearish positions for a longer period of time. When major support levels fall easily, you'll know that panic has set in.

European bond auctions are the key to all of this. If they start to go poorly and interest rates spike, the problem will accelerate quickly. If the demand is mediocre and rates gradually climb, the problem will take a few months to reach a breaking point.

The earnings news this week is fairly light. Retailers will post results and for the most part, they should be good. Consumers have been spending money and year-over-year comparisons are easy to beat.

The economic news includes PPI, CPI, initial claims and LEI. I am not expecting any surprises from these releases and they will not have much of an impact on trading.

All eyes will be fixed on Europe. The sharks are circling and they sense weakness. Watch for early morning rallies and late day selling. That will signal that the bears are in full control. If this pattern sets in, option expiration could provide additional downward momentum.

We are below critical support at SPY 115 and I am buying puts on any rally.

Daily Bulletin Continues...