Politicians Can’t Change – The Market Is Preparing For A Credit Crisis!

Last week, the market sold off sharply as concerns of a European credit crisis escalated. Greece had barely secured its aid when the market started to size up its next victim. Interest rates in Spain and Portugal started to rise. Global markets posted huge losses and the Dow Jones Industrials lost 1000 points last Thursday on an intraday basis.

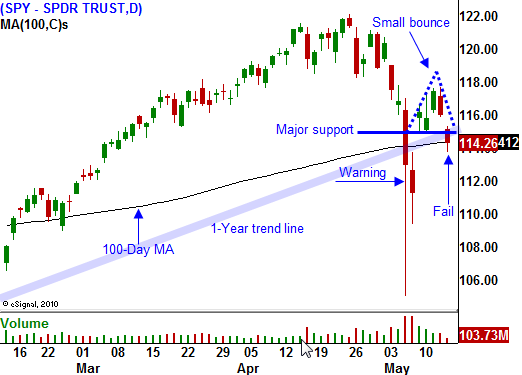

Some of that huge decline was related to a failure in electronic trading systems. Once critical support was breached at SPY 115, stop orders were triggered and all investors tried to pile through the exit at one time. Lost in the investigation is the fact that fear was the catalyst. Investors quickly relived the horror from a year ago and they decided to sell stocks.

Over the weekend, the EU devised a decisive plan of action. They have been noncommittal during the Greek credit crisis and investors lacked confidence. A $1 trillion aid package was drafted to help EU members that were in financial dire straits. That news surprised the market and we saw one of the largest one-day rallies ever. This was a bold move and it was designed to create "shock and awe".

As the week progressed, the market continued to rally. However, the Eurodollar was spared no mercy and it was crushed. Traders soon realized that this proposed "monster slush fund" lacked substance. Countries like Spain, Portugal, Italy and Ireland have already been asked for money to bail out Greece.

These countries are already on the verge of needing aid, yet they are being asked to help out another EU member. In reality, there is no money. Debt levels are already astronomically high. France, one of the "stronger" members has not had a budget surplus in over 39 years. Germany has been kicking and screaming during the entire bailout process and it could easily decide to fend for itself. Without Germany, the entire EU will fall apart.

Austerity programs will take a long time to pass and riots are already breaking out during the early stages of the process. Unfortunately, the cuts that have been proposed are miniscule in nature and they will do little to solve the problem. Massive reforms to pension and retirement benefits need to be enacted immediately. Anything less won’t put a dent in the problem.

People have not saved for their retirement and they are completely reliant on the government. Any reduction in benefits will dramatically impact their standard of living (hence the rioting).

The same holds true in the US. The average baby boomer has less than $80,000 saved for retirement. This problem will grow exponentially as the population ages. Social Security is already paying out more than it receives and this was not projected to happen for another six years.

These problems have not just popped up. They have resulted from decades of overspending. Conservatives fight to keep taxes low and liberals fight for social spending. Both sides get what they want and politicians win votes as our national debt spirals out of control. Lower revenues and increased spending will soon run their course. Politicians are unable to change direction and even if they wanted to, the solutions would take too long to pass.

Nothing can shake the market like the fear of a financial collapse. We witnessed that last year. Horrible lending decisions did not disappear. The risk has simply been shifted from financial institutions over to the government. Our national debt has gone from $2 trillion 10 years ago to $15 trillion today. In the last week, Fannie Mae and Freddie Mac have asked the government for billions in aid. I've read estimates that each entity might need $400 billion in funding before this crisis ends. To put this into perspective, TARP for all banks was only $175 billion.

In two short years, 100% of our annual tax revenues will be spent on interest and entitlement – just those two items. That means that all of the other expenses ($1.4 trillion per year) like defense, homeland security, education, and transportation will drag us further into debt each year. This does not even include the trillions of dollars that will be spent on a national healthcare program.

Corporate profits have been phenomenal and interest rates are low. Unfortunately, when the economic foundation for the Western Hemisphere starts to cave in, valuation means little. All assets depreciate as investors try to get liquid. Financial institutions try to assess counterparty risk and interbank transactions freeze. This scenario should not sound that far-fetched. We just went through it a year ago. The difference is that entire countries (not just financial institutions) are at risk.

I believe that the highs of the year are in. We are in the early stages of the decline and fear is elevated. Traders no longer trust the promises that are made.

The market is likely to make a series of lower highs in coming months. Governments will try to stop the bleeding and they will initiate programs in an effort to restore confidence. These events will generate short-lived "snap back rallies". When the dust settles the selling will resume.

By late summer, the credit crisis will worsen and economic conditions will deteriorate. That is when we will see sustained selling.

Let's suppose that politicians do the unthinkable and they actually take meaningful action. Massive cuts to social programs/retirement benefits and huge tax hikes will send us into an economic depression. Our nation will either default in coming years or it will tighten its belt and scrimp to get by for decades. In either case, pain lies ahead. We have painted ourselves into a corner and now we simply have to decide which path to take. History tells us that we will continue to spend more than we make until the money runs out.

Here’s how to profit from this sorry state of affairs. Short every failed rally. In the early going, take profits and expect snap back rallies. When those rallies become less frequent, you’ll know that investors are ready to throw in the towel. Major support levels will fall easily and that is when you need to hang on to positions. You can already start to buy long term options (4-6 months out) that are far out of the money (20% or more). Scale into these trades. Focus on companies that rely on credit (heavy equipment, banks, and consumer stocks). Any company that carries a lot of debt and needs cash flow (airlines) will be in trouble. Keep your long term put positions and add to them in coming months. Have shorter term capital available to get in and out of front month put options in the early stages of the decline.

I realize that many of you rely on me for speculative advice. From an investment standpoint, be in cash or be short. Short positions will outperform gold.

Daily Bulletin Continues...