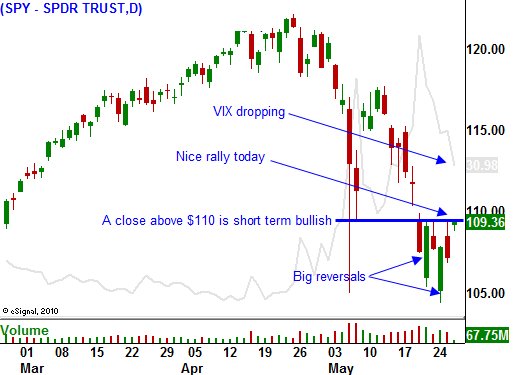

This Rally Will Last A Few Days. Watch For Resistance At SPY 112 and 115!

Today, we finally have signs that temporary support has been established. The SPY has tested the February lows of 104 three times this month and in each case, a strong intraday reversal has occurred.

Rumors circulated that the Chinese are dumping Eurodollars and that is why the market erased its gains yesterday. Chinese officials stated that they are not selling the currency and that is the main driver behind today's rally.

Japan reported that exports increased 40% year-over-year in April. Strong demand in Asia was a primary factor. Many analysts feel that China's economy will start slowing down because of the European crisis and Japan’s exports will temporarily dispel that notion.

As I've been stating this week, the sharp intraday reversals that came during deep declines signaled support. Asset Managers were nibbling and many still feel that Europe won't affect our economic growth. Great earnings, strong balance sheets and low interest rates are a powerful combination. Bulls feel that corporations are in the "sweet spot". Economic conditions are improving and interest rates are low.

This morning, Q2 GDP was lowered to 3% from 3.2%. Economic activity was not quite as robust as originally projected. State and local governments reduced spending by 3.9%, the largest drop since 1981. They are running out of money and they have to balance their budgets. As I've been telling subscribers, this is going to weigh on unemployment the rest of the year. Initial jobless claims shocked the market last week and they rose to 471,000. This morning, they came in as expected at 455,000.

The four-week moving average for initial jobless claims has been rising. Government stimulus programs are winding down and corporations are not hiring. They see the uncertainty in Europe and they don't want to add to overhead. S&P 500 companies generate 25% of their net income from Europe. I believe that the unemployment rate will start creeping higher this summer. A week from tomorrow, May's Unemployment Report will be released.

Trading next week will focus on major economic releases. ISM manufacturing, ISM services, the ADP employment index and the Unemployment Report will drive the markets. ISM manufacturing and ISM services have been strong and they should support today's rally.

Bears are fearful that the EU might take preemptive action over the weekend to fend off a credit crisis. They are taking profits on short positions and that is another reason for today's rally. End of month fund buying will also support this rally the next 2 days. I have been expecting this bounce and I believe the SPY can easily run up to 112. As it gets closer to 115, resistance will build.

During the last week, we have taken profits on our bearish positions and I have been advising subscribers to sell out of the money put premium. Option implied volatilities were sky-high and this trade had a huge edge to it. The VIX has plunged 33% this week and this trading strategy has worked out well. As the market approaches the first resistance level, evaluate the price action. If this bounce stalls at that level, buy back your puts. If it easily runs through 112, we are likely to get back to SPY 115.

Markets don't go straight up or straight down. I am playing the bounce, but I am very bearish. This is an oversold move and we will see short covering. The troubles in Europe are just starting to mount and they are painted into a corner. When this rally stalls, we will aggressively load up on puts again.

The momentum during the last year has been strong and this rally will die hard. There are bulls who view this recent decline as a "normal correction" and they will be buying the dip. In the early stages of a market transition, the snap back rally's can be very sharp. We are in the early stages of this bounce, let's see how high it can go before it hits resistance.

Eventually, the rallies will lose their amplitude and a series of lower highs will discourage buyers. That is when investors start to throw in the towel and sustained selling sets in. The credit crisis horror from last year is still fresh in everyone's mind. Investors will be proactive and they will be quicker to hit the sell button this time around. They don’t want to re-live that nightmare and the selling will resume in a week or two.

We have had incredible bullish and bearish stocks in our watch lists. Pay careful attention to my market comments. This is a trader’s market and there are fantastic money making opportunities.

Daily Bulletin Continues...