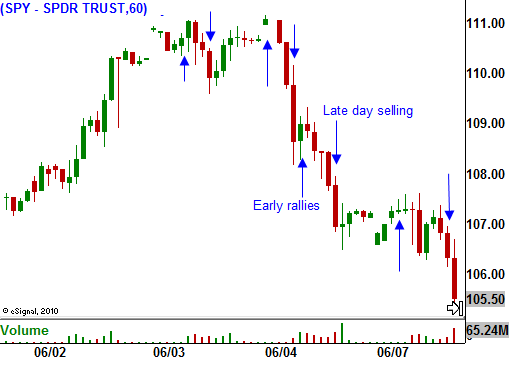

Early Rallies and Late Day Selling. This Is A Bearish Pattern!

There are too many obstacles. Around every corner there is a negative news item. The market continues to sink lower each day and a very bearish pattern has emerged. Prices start off in positive territory and the market finishes on its low with late day selling.

Europe is the biggest concern. Overnight, Fitch warned that the UK's austerity programs need to be much bigger if deficits are going to be reduced to acceptable levels. Latvia, Estonia, Romania, Bulgaria and a host of other small nations are teetering on default. Any of them could default at a moment's notice. As fear continues to build, credit markets will dry up.

North Korea, Afghanistan, Israel, Thailand and Iran all pose the threat of political conflict. A major news event could come from any of these sources at a moment's notice.

The oil spill in the Gulf of Mexico continues to grow and tempers are flaring up. Now the shores of Florida are in harm’s way during an important tourist season. Hotels are already feeling the pinch as travelers cancel reservations.

As if investor’s did not have enough to worry about, last week's Unemployment Report was much weaker than expected. Now many analysts believe that a double dip recession is possible.

I have been forecasting market weakness for many of the reasons mentioned above. When the market transitions from a strong up trend, violent snapback rallies follow the big declines. We are not seeing that and the bounces have been small. This tells me that the selling pressure is strong and we are likely to break support at SPY 104.

Bulls have quickly given up trying to buy this dip. They can see that there are too many issues and that investors want to bail on their holdings. Support at SPY 104 has previously produced large reversals. In the last few days we have easily drifted back down to this level without any rallies.

If the market closes below SPY 105, I am buying back the put spreads I have sold. Most of the stocks have been holding up well. Implied volatilities were high when I established these positions and they are back to the levels when I initiated the trades. Time premium decay has been working in my favor and even though the stocks have pulled back a bit, the positions are close to breaking even. This is the "edge" I have been referencing. Even though the position has moved against me and I was wrong (the market did not bounce), I am not losing much if any money on the trades. To this point, bullish put spreads had a positive risk/reward ratio.

It is important to keep your strategies fluid during these transitional periods. Now, I am selling out of the money call spreads in June and I am buying out of the money puts in July. This strategy allows me to sell expensive option premium and that helps to negate the expensive premium I am buying. If we get a nice decline, I will also consider selling June put options against my July put option positions. All told, I believe all the bad news is factored in and we will drift lower. If this scenario plays out, the call spread in June will expire and so will the June puts. That will leave me with a July put position at a good price.

The key in this market is to make sure that you are selling option premium. Implied volatilities are very high and the odds are stacked against you if you just purchase options.

I'm fairly confident we will break below SPY 104 this week (it could come on the initial claims number Thursday). If we gradually drift below support on late day selling, look out! That type of orderly selling means that there is more downside to come. Alternatively, we could drop quickly below 104 and in the midst of a nasty decline, prices could find support. Then, we snap back above SPY 105. Stops would be triggered on the breakdown (causing the deep decline) and bears would get suckered into short positions. The snap back rally would signify that support is holding and shorts would run for cover. It would also mean that 104 will hold if there is some follow through buying. This type of price action is often referred to as the “clean up”.

Unfortunately, I believe the first scenario is more likely. The negative news is overwhelming and we are likely to see late day selling. Try to sell out of the money call spreads and use the proceeds to buy puts. Let today’s rally run its course and watch the price action late in the day. If the market stalls, start entering bearish positions.

Daily Bulletin Continues...