The Market Should Start To Settle Down. The Major News Events Are Factored In!

Just a couple of months ago, analysts claimed that equities were in the "sweet spot". Earnings were fantastic, balance sheets were strong, economic conditions were improving and interest rates were low. Technically, stocks broke out to a new relative high and the one-year trend line provided plenty of upside momentum. Bad news (what little there was) was discounted.

The scene as changed dramatically in just a matter of weeks. From a fundamental standpoint there are warning signs everywhere. First, let's start abroad.

Nothing could be more damaging than the threat of a credit crisis in Europe. Debt levels are extraordinarily high and austerity programs will have a negligible impact on deficits. The PIIGS are getting all of the attention, but the problem is widespread. Without question, smaller countries will be lining up for handouts. Last week, Hungary announced that they are perilously close to default. Latvia and Bulgaria are also at the tipping point. Even large countries like England have massive levels of debt and they are a threat.

The market does not believe that the EU will survive. Traders are crushing the Eurodollar and it continues to make new lows. The $1 trillion slush fund that was announced a few weeks ago meant nothing and the EU's words carry no weight.

There are a host of international conflicts that are heating up. Iran is close to having a nuclear weapon, our war efforts in Afghanistan are not yielding the results we had hoped for, Israel is aggressively engaging Palestine and North Korea sank a South Korean warship. A new conflict could break out at any time.

The oil spill in the Gulf of Mexico is much worse than expected. One complication after another has prevented BP from containing the leak. Economies across the entire southern seaboard will suffer for many years.

Last week, there were signs that the economy is starting to weaken. The US added 431,000 jobs in May. Unfortunately, 411,000 were related to census workers. In a few months, these workers will be laid off and they will drag employment lower. The number was much weaker than expected and the private sector is not hiring. With S&P 500 companies earning more than a quarter of their profits in Europe, it's not surprising that they want to wait before they hire. With each passing month, state and local governments will be letting workers go as they try to balance budgets.

In addition to all of the other concerns, now the threat of a double dip recession looms. China relies heavily on exports and more than a quarter of their shipments go to Europe. Last week, China's PMI fell more than expected and now analysts wonder if growth projections need to be trimmed.

On a technical basis, most foreign markets are down much more than ours. US financial markets (stocks and bonds) have experienced a flight to quality. Even so, our market has suffered big losses. Key support levels have been broken and the selling pressure is persistent. The market is trading below the one-year up trend line, the breakout above SPY 115 failed and we are trading below the 200-day moving average.

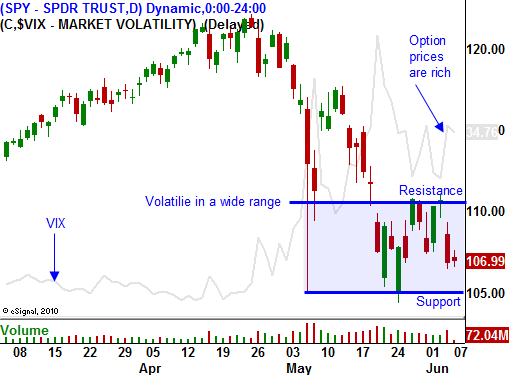

The market did find support at SPY 104 which was the low from February. Each time that level has been tested, a sharp reversal has occurred. That indicates strong support.

In the last two weeks, the market has staged huge declines and huge rallies. There is extreme volatility in a wide range and I believe those swings will start to settle down. The market has already priced in a major event. Option implied volatilities are high and they are likely to come down from current levels. It is unlikely that we will see a sovereign failure, a war or crumbling economic activity in the next month. The summer doldrums will set in and we will trade in a range while conditions deteriorate.

The path of least resistance is down. There are many negative news items that are weighing on the market. However, there is an underlying bid to the market.

Earnings season has ended and the major economic releases have passed. As the market starts to settle down in coming weeks, option premiums will decline. That means we should focus on options selling strategies. I am more inclined to sell put premium at this stage.

Many stocks have been trashed and they could easily bounce 10 to 20% on a short covering rally. This makes selling out of the money call credit spreads relatively dangerous. Even though the stock might be headed lower in the long term, it could easily stage a rally that would shake us out of that position.

I would rather sell out of the money put credit spreads on strong stocks that have held up well during the market decline and have strong support levels. This type of strength tells me that buyers are accumulating shares. They will support the stock and even if the market tanks again, the shares are likely to hold up. As long as SPY 104 holds, stick with this strategy.

Use the Live Update table and look for these stocks. Keep your size small and focus on generating a little income while we wait for the next down leg. Watch the VIX. If it drops below 25, you can start buying longer term OTM puts on weak stocks.

Daily Bulletin Continues...