Turnaround Tuesday Produces A Nce Rally – It Won’t Last!

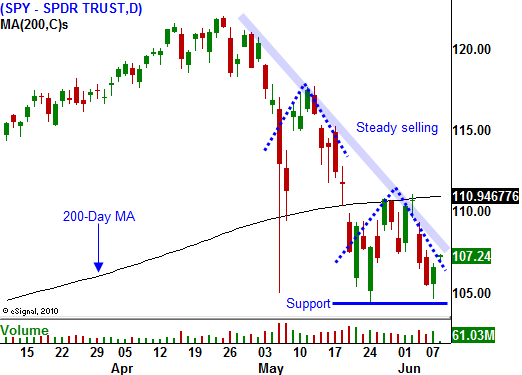

Yesterday, the market tested support at SPY 105 and bears did not have enough conviction to force a technical breakdown. As the day unfolded, bulls kept nibbling away and a nice rally unfolded. It is fairly common to see the market reverse an oversold or overbought condition on the second trading day of the week. That is why it often referred to as "Turnaround Tuesday".

There really isn't much news to drive the market this week. In a few hours, the Fed will release its Beige Book. I am expecting to see moderate growth nationwide and that should provide a little upside. Tomorrow, initial jobless claims will be released. Analysts are expecting 460,000 new claims. That is a relatively high number and it will be bearish for the market if we hit that estimate. The job scene has been deteriorating and the four-week moving average for initial claims is on the rise. After last week's dismal Unemployment Report, traders are starting to factor in a double dip recession.

The path of least resistance is still down. Bad news can come at any time from any direction. Political unrest (Iran, Israel, Afghanistan, Thailand, and North Korea), the EU credit crisis, deteriorating economic conditions or the spreading oil slick could ignite the next round of selling.

Major technical damage has occurred and it's just a matter of time before we break below SPY 104. I believe we might see that happen this week if the initial jobless claims number rises above 460,000. There simply isn't enough good news to keep investors engaged. They remember the horror from last year and they are selling stocks.

The last hour of trading is important. Recently, we have seen heavy selling into the closing bell. That is a very bearish pattern. Prices opened higher this morning. Once this rally loses its steam, bears will test the downside. Try to sell some June out of the money call credit spreads and use the proceeds to buy longer-term out of the money puts.

The Beige Book will provide a little afternoon strength, but that will quickly fade. I believe sellers will push prices lower into the close and the initial jobless claims number will be weak tomorrow. With the strong downward momentum, I'm not too worried about an upside surprise. The rallies have been contained and sellers unload stocks when there is a bid to market.

The last two market bounces were brief and shallow. This indicates that sellers are always nearby.

Options are expensive. Make sure you sell call spreads to reduce the cost of your puts.

Daily Bulletin Continues...