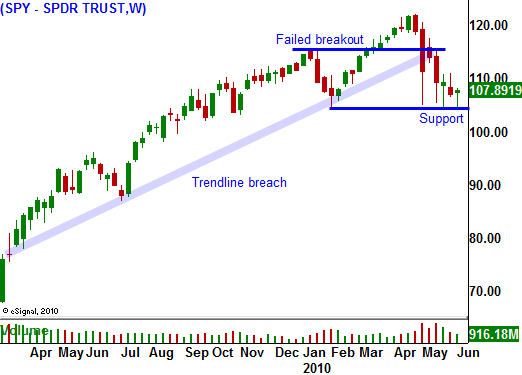

Early Strength – Late Weakness. This Is A Bearish Pattern!

The market continues to look weak from a technical and a fundamental standpoint. Major support levels have been breached and negative headline news is released on a daily basis.

First, let's look at the price action. The market has broken its one-year up trend line. There have been two bounces and in each case they were brief and shallow. Sellers are anxious to unload stocks on every rally and the selling pressure is strong. This has resulted in a series of lower highs. We are below the 200-day moving average and the volume has been heavy during big declines. Recently, the market has rallied early in the day and sold off late in the day, closing on its lows. This is a bearish pattern and the technicals look weak.

From a fundamental standpoint, credit concerns, political conflicts, the oil spill, new regulations and the potential for double-dip recession haunt the market.

The credit crisis in Europe is having the biggest market impact. Massive debt levels will challenge the strength of the EU. Portugal, Spain, Ireland, Italy, Greece, Ireland and England are the primary trouble spots. We are likely to see a sovereign failure in one of the small countries like Bulgaria, Latvia, Estonia or Romania in the near future. Even the strong countries have high debt levels and France has not had a budget surplus in four decades. Traders do not believe that the EU will survive and they are dumping Eurodollars.

We are waging a war in Iraq and Afghanistan. The progress is very slow and the target date of our withdrawal is approaching. Meanwhile, Iran is close to having a nuclear weapon. Israel, Thailand and North Korea are also political hotspots. A major crisis can strike at any time

The oil spill in the Gulf of Mexico is much worse than expected. BP can't stop the leak; they can only capture a fraction of what is gushing out. Unfortunately, the oil they collect is greater than what they originally estimated was coming out of the well on a daily basis. The slick is spreading and it has hit the beaches in Florida. This catastrophe could destroy a major oil company that produces $20 billion a year in profit. One event like this can wipe out a company overnight and the entire energy sector is selling off.

Politicians are hammering out the financial reform bill. This will reduce banking profits and bank stocks have been weak.

Last Friday's Unemployment Report was dismal. Almost all of the jobs created came from the temporary employment of census workers. Government stimulus programs have run their course and public jobs will start to decline as state and local governments lay off workers to balance budgets. Corporations are not hiring. They want to make sure that demand is sustainable and that the recent recovery is not just an inventory cycle. S&P 500 companies get 25% of their profits from Europe and they won't add staff until they see how the credit crisis plays out.

This morning, initial jobless claims were released. They came in at a relatively weak 456,000. The four-week moving average has started to move higher and the threat of a double dip recession looms.

Investors remember the horror from last year and they don't want to relive it. Portfolios recovered somewhat and people are not taking any chances. They are unloading their stock positions and heading for the sidelines.

Earnings season is over and the economic news is fairly light next week. Most of the bad news has been factored in and the market is likely to settle down. Option implied volatilities are high and they will decline as the trading range contracts. Conditions will deteriorate in coming months and the next down leg will start in August.

While I expect a more stable trading environment in the next few weeks, one bad news event could change everything. The most likely source would be a failed bond auction in Europe. This week Spain and Portugal successfully raised money and we are safe for the time being. The key support level is SPY 104. If it fails, the next wave of selling will begin.

This is an excellent time for spreading strategies. I am selling out of the money call spreads and I am using the proceeds to purchase longer-term out of the money put diagonal spreads. This approach allows me to capitalize on time decay and a drop in implied volatility. Once the options expire, I will be left with longer term out of the money puts at a great price. That will position me for the next decline late this summer.

Daily Bulletin Continues...