Look For A Decline In Volatility – Sell Out of the Money Spreads!

Yesterday, the market rallied on a strong export number from China. Economic conditions have not slowed down as many had feared. China depends heavily on exports and more than a quarter of their outbound shipments go to Europe.

Conditions in the EU are deteriorating and it will take time for that to impact China. Massive stimulus programs around the globe have run their course and inventories have been replenished. I expect to see signs of a widespread slowdown in coming months.

This morning, retail sales in the US declined by 1.2%. Analysts had been expecting a rise of .2%. Severance packages and unemployment benefits are running out and consumers are cutting back on discretionary spending. This was a "pure miss" and the dismal results can’t be blamed on a holiday or bad weather.

Yesterday, initial jobless claims came in at 456,000. That was in line with expectations, but it was a relatively high number. The four-week moving average is starting to climb and as we saw in last week's Unemployment Report, the private sector is not adding jobs.

Bad news hangs over the market like a dark cloud and lightning can strike at any time. Conflicts in the Middle East (Iraq, Iran, Israel and Afghanistan), Thailand or North Korea can rattle the market at any time. The oil spill in the Gulf of Mexico continues to spread and the destruction will be devastating. New regulations will be imposed in the energy and financial sectors and profits will decline. Miniscule austerity programs in Europe will do little to balance budgets and future bond auctions will go poorly.

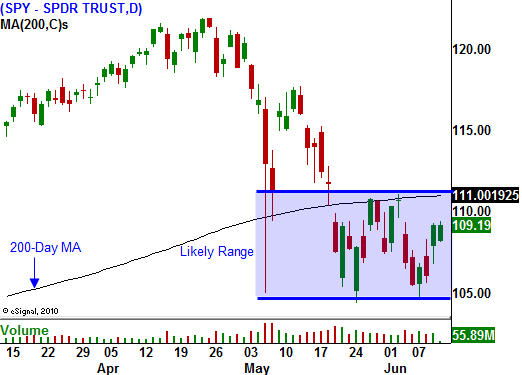

Much of the bad news has been factored into the market. We are likely to see prices stabilize and the volatility will collapse. Conditions won't deteriorate overnight. In coming months, the selling pressure will build and the market will stage its next decline late this summer.

I have been selling out of the money front month call credit spreads. I am using the proceeds to purchase longer-term out of the money puts. I am also selling front month puts against that long term put position. When the front month options expire, I will be left with long term out of the money put positions at a very reasonable price. Over the course of the next two months I should be able to build a nice portfolio and I will be ready for the decline in August or September.

If bears can't get anything going early this morning, bulls will see if they can add to yesterday's gains. The retail sales news was not that dire and it could be dismissed as a one-time event. Keep your distance and focus on option selling strategies.

Earnings season is over and the major economic releases are out of the way. The market should start trading in a more defined range in coming weeks and you will benefit from a decline in implied volatility and time premium decay.

Daily Bulletin Continues...