Don’t Get Suckered Into This Rally. This Is Just A Bounce!

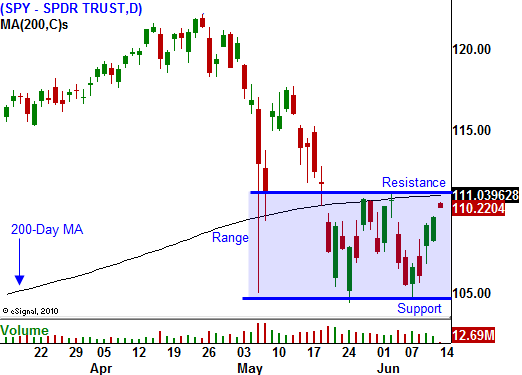

The market has been able to stage a rally for three consecutive days. It has successfully tested support at SPY 104 and as we drifted down to that level last week, buyers stepped in.

Conditions will deteriorate over the next few months and the extent of the slowdown won't be known for quite some time. For now, the market seems comfortable holding this support level.

Strong export numbers from China boosted the market last week. The buying continued into Friday. This morning, a better than expected industrial production number (.8%) in Europe sparked a rally. Bulls are nibbling at this level.

The credit crisis in Europe will continue to worsen over time. Huge deficits will not be solved by small austerity programs. EU members continue to slip further into debt and the unity will show signs of stress as more bailouts are needed. Watch for weak bond auctions in Spain.

Economic conditions in the US will also slow down and we will suffer a double dip recession. The private sector is not hiring and government (federal, state and local) payrolls will be trimmed to balance budgets. This means the unemployment rate is likely to rise in coming months. Jobs are the key to economic recovery and they're not likely to see any improvement the rest of the year.

The news is fairly light this week. PPI, CPI and initial jobless claims are the big releases. Inflation has not been an issue and I don't believe these numbers will impact trading. Initial jobless claims have been high and if they stay elevated, it will weigh on the market.

The price action in the last week is nothing more than volatility within a defined range. The market will continue to drift back and forth within the range while it searches for a catalyst. Option implied volatilities will come down and this gives option selling strategies a nice edge.

In a month or two, signs of an economic slowdown will hit the US and Europe. Bond auctions will go poorly and implied interest rates will rise. The credit issues in Europe are so large that eventually, every country will fend for itself. This collapse will freeze up the banking system and a credit crunch will result. This will be much worse than what we saw last year since it is a sovereign (not a corporate) problem.

The recent rally is nothing more than a bounce. I am selling out of the money call credit spreads and I'm using the proceeds to buy out of the money longer-term puts. I feel that resistance at SPY112 should hold and resistance at SPY 115 will hold. I'm willing to let the market rise to SPY 115 before I shut down my call credit spreads. I am buying puts in September and October so that my bearish positions can benefit from seasonal weakness. By then, the signs of an economic decline should be obvious.

Don't get suckered in to this rally. This is an opportunity to get short, not long. Let the market run its course and line up your short positions.

The volume during today's rally is light. Significant overhead resistance will keep the market from advancing. If bulls can't make a new high for the day this afternoon, look for selling into the closing bell.

Daily Bulletin Continues...