This Should Be A Quiet Quadruple Witch!

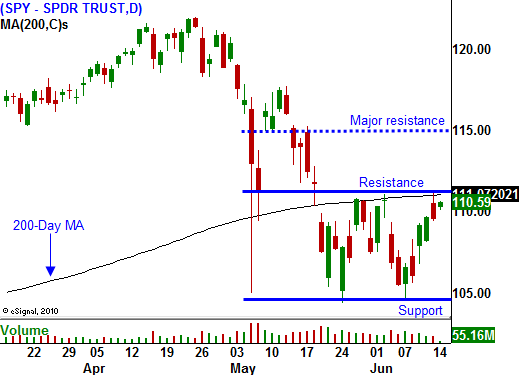

The market has rallied four consecutive days. Support at SPY 104 held and bulls are bidding for stocks at this level. The volume has been light indicating a fairly low level of conviction.

Last week, China's robust export numbers generated a nice rally. Concerns of an economic downturn were temporarily pacified. Many believe that China can pull the entire world out of this recession. I am not so optimistic. Massive Chinese stimulus and low inventory levels fueled demand. Those two events have run their course and growth will slow in coming months.

Most economic statistics are "backward looking". By the time they start to deteriorate, the market will already be trading lower because other signs of weakness will be present. Two thirds of China's economic activity depends on exports. Europe and the United States are huge customers and our slowdowns will soon be felt in China.

The Unemployment Report revealed that almost all of our job growth is tied to government spending. Corporations see the storm clouds and they are not adding staff. Last week, retail sales missed estimates by a wide margin. Severance packages and unemployment benefits are running out. Consumers are tapped out and they are cutting back on discretionary spending. Almost 70% of our GDP comes from consumption.

The situation is even worse “across the pond”. European countries have two choices. They can either make dramatic budget cuts or the market will greatly increase their cost of capital. Austerity programs will reduce economic activity and the unemployment rate will rise. If the proposed programs fail to materially cut deficits, investors won't buy their bonds. Interest rates will spike and a credit crisis will unfold. Both scenarios will reduce economic activity.

Yesterday, Moody's downgraded Greece's debt to junk. This news was largely expected, but it still weighed on the market. Conditions are so dire that the Greek government has not been paying hospital suppliers. People are dying without supplies and suppliers are owed €5.6 billion. Medicare is in a similar situation. More than 60% of all Doctors are refusing Medicare patients because they are not getting paid by our government. This really makes you wonder about our future health care under a nationwide program.

The most important news out of Europe came during Spain's bond auction yesterday. Spain raised €5.2 billion in 12 and 18-month T-bill auctions, but the yield jumped 70 basis points. This is exactly the warning sign I have been referencing. Rising interest rates indicate reluctance by investors. If this continues, Spain will be the next "dark cloud".

The economic news is rather light this week (PPI, CPI and initial claims) and it should be a quiet week. Quadruple witching can always change that, but the market seems comfortable in its current range. If we break out above SPY 112, option buy programs could spark a rally up to SPY 115. The volume has been light and I'm not expecting this to happen.

I expect the market to drift around in a trading range during the next two months. By then, conditions will deteriorate and the selling pressure will build. By the end of summer, the next down leg will have started.

We have seen a nice bounce and earning season is only a couple of weeks away. The market has had a tendency to rally into earnings. Investment banks will lead things off and the results could disappoint. IPOs, refinancing and trading should all be down from last quarter's levels. Be patient and wait for resistance – then sell out of the money call spreads.

Daily Bulletin Continues...