After A Brief Rally Last Week – The Sell-off Continues – Buy Puts!

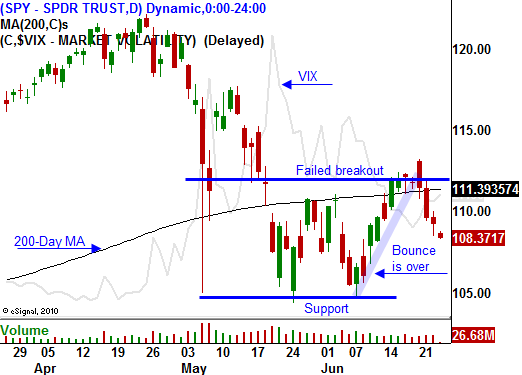

This morning, the market is drifting lower and we are clearly below the 200-day moving average. Last week's mini-bounce was short-lived and it resulted from a deeply oversold condition. Quadruple witching and short covering played a role in the rally. The volume was light indicating a low level of commitment.

As I mentioned yesterday, there have been a series of negative news releases and they are starting to take their toll. This morning, initial jobless claims fell after last week's spike. Analysts were expecting 460,000 new claims and there were only 457,000 new initial jobless claims. While this was slightly better than expected, it is still a dismal number. Durable goods orders fell more than 1% and it is also weighing on the market.

Before the two statistics were released, the market was down 10 points in the S&P 500. That is where we currently sit and these economic releases did not have that much of an impact.

Housing starts, existing home sales, ISM manufacturing, Empire State index, Philly Fed, and the Unemployment Report all raised concerns of a double dip recession in the last two weeks. When you add the possibility of a European credit crisis, the worst man-made disaster ever and global political conflicts to the equation, there's not much to get excited about. Investors are selling stocks and they are reducing risk.

Astronomical debt levels have accumulated over decades and every solution involves pain. If austerity programs are passed in a material way, economic activity will drop quickly. It will take decades for countries to work themselves out of this mess and drastic cuts to retirement/pension benefits and healthcare will meet heavy opposition. Riots and civil unrest will result. If costs are not controlled, budget deficits will continue to escalate. Credit ratings will fall and the probability of a global financial crash will increase.

Given the two scenarios, you have to be long-term bearish. It's true that corporate valuations are low. However, when people need cash to put food on the table, they sell anything of value - that includes stocks that might seem cheap. As I have pointed out before, stock valuations mean nothing in a financial collapse.

I was hoping for more of a bounce, but we did not get one. In yesterday's comments I suspected a selloff today. I started buying puts and I will be adding to positions today. The path of least resistance is down and support at SPY 105 will be tested. I don't think we will break below that level ahead of earnings, but I want to be long puts in case we do. There has been a tendency during the last three quarters for stocks to rally into earnings. That pattern might be broken if traders suspect that Q3 guidance will be cautious.

Buy longer-term puts on weak stocks. I am expecting a drift lower into the close. Tomorrow's GDP number should be revised slightly lower and traders will not want to go into the weekend long stocks now that we are below the 200-day moving average. The market never rallied enough to calm fear and pessimism has returned.

Daily Bulletin Continues...