Negative News Is Mounting. The Breakout Failed and We Are Below the 200-Day MA!

The market shouldered negative news during quadruple witching last week. Option expiration buy programs and short covering sparked a rally. The volume was light indicating a low level of commitment.

Monday, news that China might let the Yuan float raised spirits. A stronger Asian currency would mean that US exports are cheaper on a relative basis and it would put us in a more competitive position. The market rallied after the release and it was convincingly above the 200-day moving average. By late afternoon, the gains had vaporized and we closed near the low of the day. This intraday reversal gained traction on Tuesday as the S&P 500 dropped 20 points.

As I have been mentioning, a stronger Yuan also has consequences. Chinese imports would become much more expensive and that is inflationary. Higher prices would put upward pressure on interest rates.

In the last two weeks, the market has been able to ignore a series of negative news releases. The credit crisis in Europe is of greatest concern. Last week, Spain auctioned €5 billion in 12-month and 18-month bonds. These short-term maturities are normally considered "safe", but interest rates jumped 70 basis points. This indicates that fear is rising.

This morning, Portugal auctioned €1 billion of one-year T-bills. Interest rates on these short-term securities rocketed 100 basis points. Clearly, there is a lack of investor confidence. The PIIGS will hold large bond auctions in the next few months and the appetite for their debt is decreasing. This is the biggest warning sign we can monitor. As yields escalate, the risk of a sovereign default increases.

Signs of a double dip recession are surfacing. ISM manufacturing declined slightly in May indicating that the inventory cycle has run its course. The Empire Manufacturing Index and the Philly Fed came in much lighter than expected last week, supporting that theory. ISM Services Index was flat in May. This afternoon, the FOMC will release its statement. We are likely to hear that economic conditions are fragile nationwide and that the Fed will maintain its "dovish" policy. This news could set up an afternoon decline.

Traders will be nervous ahead of the initial jobless claims number tomorrow. Last week, 472,000 new applications were filed. That was much greater than expected and the four-week moving average is climbing. This one indicator is closely followed because it has its finger on the pulse of the economy. The Unemployment Report released two weeks ago was dismal. Almost all of the new jobs that were created came from temporary census employment.

President Obama painted a rosy employment picture but analysts quickly saw through the smoke. High-speed trains to nowhere and cash for clunker rebates did little to stimulate jobs. He has mishandled the oil spill disaster and a Federal Judge in Louisiana is challenging his moratorium on drilling. We are preparing for a major assault against the Taliban in Afghanistan and one of the President’s highest ranking generals publicly made derogatory statements. Today, we will see if he is forced to resign. Illegal aliens (and terrorists) pour across our border and Obama has done little to stop it. Arizona reluctantly took matters into its own hands and now it is being sued by the government. Obama’s popularity in the polls is dropping quickly.

New home sales dropped 33% in May to their lowest level in 4 decades. People are handing over their keys and banks are taking a bath. Without jobs, home prices will continue to drop as banks dump foreclosed properties.

I was hoping for more of a rally ahead of earnings season, but I doubt we will get one. The news has been very "heavy" and I can feel the selling pressure.

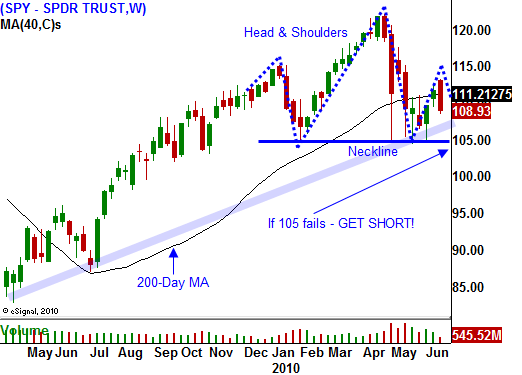

As long as the SPY closes above 105, I will maintain my put credit spread positions on strong stocks. After seeing the price action this week, I am starting to buy longer-term out of the money puts. I don't care if I am a little early, I just don't want to miss out on one of the biggest moves of the year. If the market moves higher, I will add at better prices. If it tanks, I will buy more puts aggressively.

Durable goods orders are volatile and they could swing either way tomorrow. The final revision to Q1 GDP will be released Friday and I am expecting a small decline. Neither release should have a big impact relative to all of the other dark clouds.

Look for an afternoon sell off after the Fed release. Everyone is expecting them to maintain the current policy, but they do not expect to hear that the economy is stumbling.

Daily Bulletin Continues...