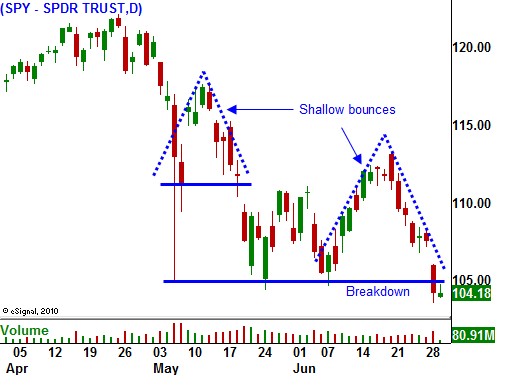

Major Technical Support Was Broken – Buy Puts and Wait For the Next Round of Selling!

Yesterday, the market got off to a bad start and the selling momentum accelerated throughout the day. By the close, the S&P 500 futures had dropped 40 points. We closed below critical support at SPY 105.

News that China's LEI showed an economic decline spooked the market. Overseas markets were trading lower and we were poised for a selloff. At nine o'clock (central time), consumer confidence was released and it dropped to 52.9 from 62.7. That was all the negative news the market needed for a nasty round of selling. The volume was heavy and the breadth was staggering.

This morning, we are seeing a small relief rally. Apart from the market getting a little ahead of itself, I can't justify the rally this morning. The ADP employment index was horrible. Analysts were expecting 61,000 new jobs in the private sector and there were only 13,000 new jobs. This does not bode well for Friday's number.

Yesterday's decline broke major technical support levels and the next shoe will drop soon. One shred of bad news is all it will take to start the next leg down. Initial jobless claims have been weak and a bad number tomorrow could be the catalyst. We'll also get ISM manufacturing. Although Chicago PMI came out as expected this morning, Empire Manufacturing and the Philly Fed were dismal last week. That leads me to believe that manufacturing will slow down. Analysts are expecting 450,000 new jobless claims and they are expecting 59.0 for the ISM index.

The credit crisis in Europe poses the greatest risk. If bonds yields start jumping during the next round of auctions, fear could push the EU over the edge.

A slowdown in China would also spark selling. The government could raise interest rates and they are close to letting their currency float. Either one of these two measures would slow economic growth. China has cash and the whole world is counting on them to pull us out of this recession.

Domestic economic releases are pointing to slower activity. This has been a jobless recovery and the threat of a double dip recession looms. Consumers are tapped out and they don't have the spending power needed to revive our economy. Unemployment benefits and severance packages are running out and people are hanging on to the money they have.

The market has easily fallen to a major support level and we have closed below it. I do not trust this morning's rally. The news was not good this morning. Nervousness will set in ahead of tomorrow's releases and Friday's Unemployment Report. Look for afternoon selling

As I have been saying, buy puts. Yesterday's breakdown was very damaging and the next big move is down. Asset Managers will not be buying this dip now that major technical support was breached. Any little rally will be met instantly with selling. We will probably establish support at a lower level just before earnings season begins in two weeks. For now, get short and wait for the next event it takes us lower.

Daily Bulletin Continues...