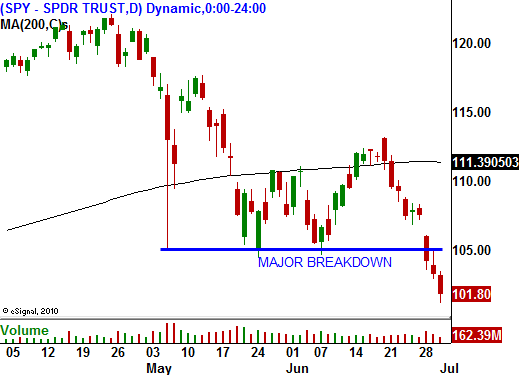

Good Night Irene! The Long Term Trend Will Be Down – Short Any Rally!

For the last 7 trading days I have had one central message in my market comments. BUY PUTS!

The credit crisis in Europe grows, economic activity in China is slowing and our own statistics point to a double dip recession. Fear rules “the street” and major technical support has been breached. Asset Managers that might have been bargain-hunting have stopped.

This morning, initial jobless claims were horrible. They rose to 472,000 when analysts expected 458,000. ISM manufacturing dropped to 56.2 when analysts were expecting 59. In yesterday's comments I mentioned that this was likely since the Empire Index and the Philly Fed are weak. Pending home sales were down 30%. Without question, economic conditions are deteriorating.

Traders are nervous ahead of tomorrow's Unemployment Report. As I have been saying, we may have seen the employment peak in May. The ADP employment index released yesterday showed that the private sector is not hiring. State and local governments need to balance budgets and they are cutting payrolls dramatically. This means the public sector will also lose jobs.

Now that we have broken major sport, the selling pressure will intensify. Any short covering rally will be brief since traders are anxious to unload stocks. The decline will be sustained once earnings season begins.

First, let's look at the likely price action the rest of the week. The economic numbers are horrible and the market is likely to decline into the closing bell. If we get a major selloff, most of the bad news will already be priced in and there is a slight chance that the actual number might not be horrendous. In this case, prices will stabilize and we will not see a major decline on Friday. I would consider taking partial profits on put positions into the closing bell provided we get that big decline. If we lost more than 150,000 jobs in June, the market will stage a huge decline and there is a chance for a rebound late in the morning.

From a longer-term perspective, earnings season presents a similar scenario. If traders truly believe that Q3 guidance will be weak, they will sell the market off ahead of earnings. Should this happen, the actual earnings releases could lend support to the market. At that juncture, worst-case scenarios will be priced in and option implied volatilities will have spiked. After a brief rebound towards the end of July, fear will once again rule the streets as we head into the weakest seasonal period of the year.

The credit crisis in Europe continues to grow quickly and major bond auctions will be held in coming weeks. This headwind will also put pressure on the market and that is why I believe we will selloff in the earnings season. We now have two negative pieces of economic information from China in the last week and that will also weigh on the market. The downward momentum is strong and good news will be discounted because people are scared.

If by chance the market rallies today, it will be vulnerable to a major decline tomorrow. If stocks rally into earnings season, the actual releases will be met with heavy selling. I do not believe these scenarios are likely.

On a big decline today, take partial profits. In a big decline tomorrow morning, place stop orders and protect yourself against an intraday reversal. Option implied volatilities are high and the trading activity should slow down next week. The major economic releases will be out of the way and light holiday trading will set in.

If by chance you have purchased long-term out of the money put options, stick with your positions. We are in the beginning of a sustained decline and you will have to weather a few minor rallies before you get to the “Promised Land”. A big drop looms in coming months and you don't want to get cute and miss it.

If you don't have any short positions, you haven't been paying attention to my comments. By getting in early, we have gained staying power and we are able to ride out the volatility. At this juncture, I would not be buying puts. You might consider buying longer-term put debit spreads, but realized you have missed a huge move and you are vulnerable to implied volatility decay and a snap back rally.

I’m getting lots of e-mails and most of you are making a killing – congratulations! I don’t like what the future has in store for our country, but trading profits will help ease the pain.

Daily Bulletin Continues...