Tech Stocks Should Rally On Intel News – Look For Resistance This Week At SPY 112.

The market is trying to extend its gains from last week. A decent round of earnings from CSX and Alcoa are fueling this rally. CSX said that it sees improving transportation activity across all segments and Alcoa projected that the demand for aluminum would be good next quarter.

This morning, we learned that the US trade deficit widened by 4.8%. Big imports from China were the primary reason. If China stops pegging the Yuan to the dollar, import prices will increase. This will be inflationary and our purchasing power will decline. Many US politicians are pushing for this, be careful what you wish for.

In a survey by the National Federal of Independent Businesses (NFIB), small businesses grew more pessimistic in June. Their outlook and business conditions deteriorated and they believe revenues will decline. More than 50% of the jobs in the US are tied to small businesses. They have their finger on the pulse of this economy and they don’t like what they see.

Across the pond, Greece was able to successfully auction €1.6 billion in six-month bills. Yields rose 10 basis points compared to their April auction. They had initially planned to auction €5 billion worth of one year bills, but the cost was too high. When countries (like the United States) start issuing shorter-term maturities, it means that the demand for longer-term bonds is declining and that they can’t afford the added expense. This debt has to be continually refinanced. Greece will have to refinance this same debt in 6 months. The average maturity on US debt is 4 years and we will continually be refinancing our $14 trillion in debt.

The results from Greece’s bond auction will temporarily calm nerves.

This week we have an FOMC meeting and many economic releases. The Fed will maintain its rhetoric and inflation (PPI and CPI) will be tame. The manufacturing releases (Empire Index and Philly Fed) should decline and they will have a slightly negative impact.

Earnings will be the focal point. After the close today, Intel will announce. I believe they will post good numbers and tech stocks will rally after the announcement. Then, the market will prepare for the next round of earnings. Friday's opening could be interesting. Google will announce Thursday after the close and Bank of America, Citigroup and General Electric will announce Friday before the open. Tech has room to rally, but financials should start to hit resistance soon.

As we have seen the last three quarters, stocks are likely to rally this week and next. Then, the momentum will slow and the selling pressure will mount.

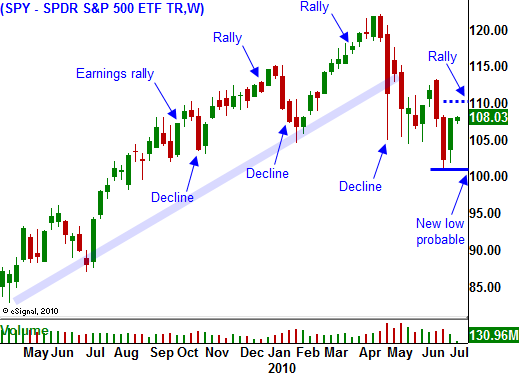

I believe the SPY could reach 112 this week. Option expiration could generate buy programs if the upward momentum is orderly. During the next two weeks, I will be looking for weakness on a sector by sector basis. We are heading into the summer doldrums and I am not expecting any big fireworks. By mid-August, prices should gradually start to slip. There will be a great opportunity to start purchasing longer-term puts in the next two weeks.

Let this rally take its course and watch for pockets of weakness after earnings have been released. The market could possibly run as high as SPY 115 before it hits a wall in 2 weeks. As a bear, I hope it does so that I can buy cheap puts.

I am patiently waiting on the sidelines. I am not expecting this to happen in the next two weeks, but if we break below SPY 105, be ready to buy puts at a moment's notice.

Daily Bulletin Continues...