Good Earnings Will Push the Market Higher Today!

As I mentioned in yesterday's comments, a light economic calendar and successful bond auctions in Europe would be market friendly. These two sources of negative information are absent this week.

Overnight, Apple smashed estimates and the stock was up $10 after hours. This morning, Morgan Stanley, Wells Fargo and U.S. Bancorp all posted good results and the stocks are rallying. The financial sector has been bracing itself for negative earnings and they weren't as bad as expected. Coca-Cola is also up in early trading. United healthcare also posted excellent earnings and that should help health-care stocks. With earnings being the focal point, this should be a positive day for the market.

The news in Asia and Europe is also light today. European markets are up 1.5% and Asian markets are up .5%.

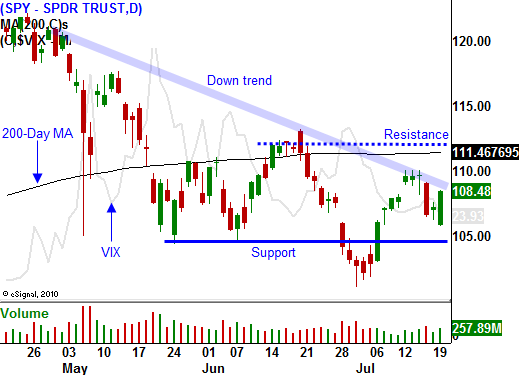

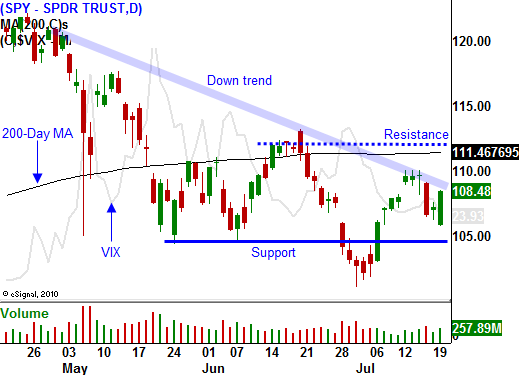

This decent round of earnings has the S&P 500 futures up 5 points in early trading. Last Friday's losses have almost been erased and the market looks poised to challenge minor resistance at SPY 110.

Bidu, Ebay, F5 Networks, Netflix and Qualcom all release after the close and I am expecting good results. Tomorrow morning, 3M, Bristol-Myers and Caterpillar will post numbers. The earnings should be good, but as more cyclical stocks announce, Q3 guidance should become a concern. Economic conditions are slowing down in Europe and in the US. China has noted that exports are falling off.

Companies have been making great money and they are attractively valued. Balance sheets are strong and US corporations are sitting on $1 trillion in cash. Interest rates are low and they will remain that way. Ask a bear, these are tough forces to trade against.

Nevertheless, massive debt levels on a federal, state, municipal and personal level will eventually take their toll. Our economy gets 70% of its activity from consumption and when people are "tapped out" they stop spending. Credit is tight and our economy does not have a catalyst. Conditions will continue to slip with each passing week and I am still expecting a market decline.

During the next two weeks, we will get a very heavy dose of economic news. I don't believe the market will be able to overcome fears of a double dip recession.

Watch for higher prices today and before the open tomorrow. I don't see anything that will dampen the spirits of bulls and we might challenge SPY 110. Heavier resistance lies at SPY 112 and major resistance sits at SPY 115. I don't think we will test 115 before the next round of selling.

I still like selling out of the money call credit spreads in small size. Look for stocks that have heavy resistance and are struggling after releasing earnings. The summer doldrums should set in and volatility is likely to decrease towards the end of July and the beginning of August. This will bode well for premium selling strategies.

As implied volatilities decline, you should be lining up your put buying candidates.

Daily Bulletin Continues...