This Rally Should Start To Stall Later In The Week!

Last week, the market did not have to fight off bad economic/credit news and it was able to rally higher on good earnings. Corporations are making great money and balance sheets are strong. Typically, earnings season kicks off with some of the strongest companies reporting early.

Economic conditions have been gradually deteriorating and there weren't any major releases last week. That will change a little this week and consumer confidence, durable goods orders, the Beige Book, initial claims, GDP, Chicago PMI and consumer sentiment will be released. Durable goods orders have been volatile and given solid earnings from Ford and Whirlpool, this number should be decent. Initial claims have been seasonally adjusted and there is so much "noise" in the number that traders are ignoring it for the time being. I feel the Beige Book and Chicago PMI could be the numbers to watch this week. They will both show a decline in manufacturing and that could raise concerns of a double dip recession.

The European stress test results were released last Friday. In general, the market has been receptive to the study. However, many analysts (myself included) feel that it was nothing more than a public relations move by the ECB. The study assumed that European banks do not have any sovereign default risk. These banks have been aggressively investing in peripheral EU nations and they are very vulnerable if the PIIGS start failing.

Last week, the European bond auctions also went well in Ireland and Spain. The previous week, Italy held successful auctions. The yields are rising, but the demand was fairly good. This condition can change in an instant. Portugal held successful bond auctions two weeks ago and last week it auctioned €1.25 billion in one year T-Bill's and the yields jumped 1%. For now, the auctions won't impede this market rally.

Before the open, FedEx raised guidance. The market rallied on the news and transportation stocks from airlines to railroads all look fairly strong. Cyclical stocks also caught a bid last week when Caterpillar, Ford and 3M reported good results.

Interest rates are so low that Asset Managers feel compelled to invest in the market. Without concrete evidence that we will slip into a double dip recession and without a sovereign default, money is gradually flowing back into stocks.

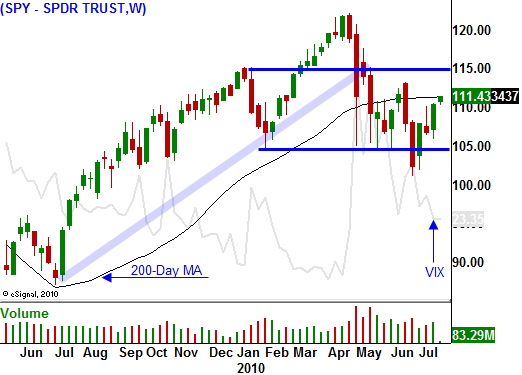

This rally can continue for another week but it will start to hit resistance. Economic conditions are deteriorating in Europe and budget deficits will continue to grow. Austerity programs are being fought tooth and nail and the cuts that have been made don't address the really big issues (retirement benefits and healthcare). The deficits will continue to escalate out of control here and abroad.

Consumption in the US will continue to decline. More than 70% of our economic activity comes from spending. Unemployment benefits and severance packages are running out. Corporations are not hiring and the unemployment rate will start to creep higher in coming months.

I am waiting for signs of resistance and I will let this rally run as high as it wants to. Option implied volatilities are declining and that plays right into my hand. I feel the next big move is down and I will be ready to buy puts. Only nimble short-term traders using stop orders should trade this rally.

The market should hit its first snag Wednesday afternoon when the Beige Book is released. Then, I believe Chicago PMI and consumer sentiment will weigh on the market Friday. Monday, ISM manufacturing will decline and that should raise concerns at the beginning of a busy week for economic releases.

Daily Bulletin Continues...